By Darrell Martin

Statistics Canada will release Canada’s Consumer Price Index news on Friday, June 23, at 8:30 AM ET. Traders track this news due to consumer pricing influencing overall inflation, which in turn can lead to interest rates rising. Either way, this news is a trade opportunity with a well-planned strategy trading the right fitting instrument for the setup.

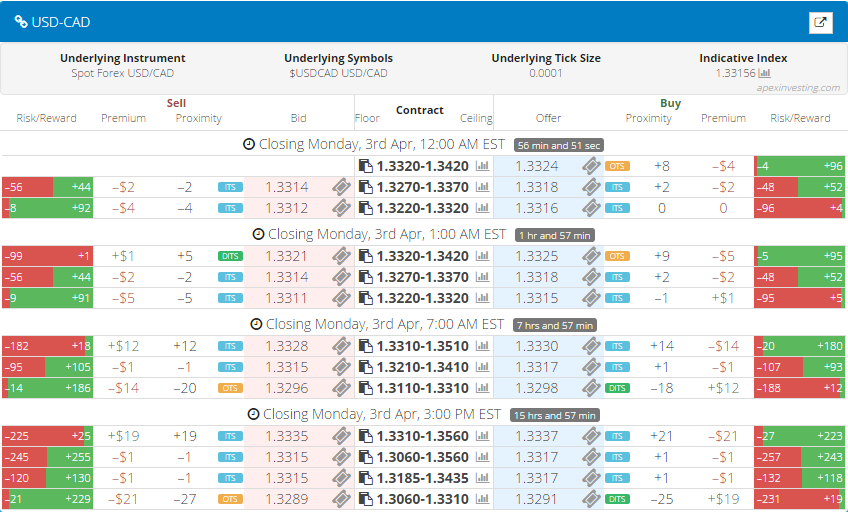

Based on 12 - 24 previous news releases and market reaction, it was found that an Iron Condor can be a high probability trade with two Nadex USD/CAD spreads. One spread is bought and one spread is sold. Each spread should have a profit potential of around $15. Spreads have a floor and a ceiling, marking the bottom and top of the range in a market, and can be traded long or short. The market can go past those points. However, there is no profit and loss past those points. In addition, the trade isn’t closed unless exited or the time expires and the spread settles. This provides great flexibility for the trader. Risk is capped and known upfront. If the trader chooses to remain in the trade and can manage the upfront risk, they can do so without being stopped out.

For the Iron Condor to keep risk at a realistic 1:1 risk reward ratio, stops should be placed.Furthermore, the ceiling of the bought spread should meet the floor of the sold spread and be where the market is trading at the time. To find the points where stops should be placed, simply double the amount of the combined profit potential for the trade. In this setup, it is 60 pips above and below from where the market is at entry. Enter at 8:00 AM ET, when the 10:00 AM ET expiring Nadex USD/CAD spreads are listed.

Trading spreads is easy using the spread scanner. It was designed for advanced traders to see multiple markets in one screen, with all the pertinent information on each spread including risk, reward, premium and more. The spread scanner’s filter along with indicative colored tools and buttons cuts the learning curve for beginner traders. For example, on this strategy, simply look for spreads that have a green reward bar with $15 or more. See below for an image of the spread scanner.

It provides the trader with the simple, immediate and accurate execution for trading Nadex spreads. Profit for this strategy is made when the market settles anywhere between the break even points of 30 pips above and below from where the market was at entry. Max profit is attained when the market pulls back to right between the two spreads and settles there.For free day trading education on spreads, binaries, futures, and CFDs, as well as free access to the spread scanner, visit www.apexinvesting.com.