By Darrell Martin

Statistics Canada, the central statistical office for Canada, will release current numbers and news for Retail Sales and Core Retail Sales Tuesday, November 22, at 8:30 AM ET. The Core report has more impact than the other as it measures total retail sales but excludes volatile Auto sales. Traders watch and care about this data due to it being the major indicator for consumer spending, which makes up the largest portion of economic activity. As such, this news makes for a trade opportunity using an Iron Condor strategy trading Nadex USD/CAD spreads.

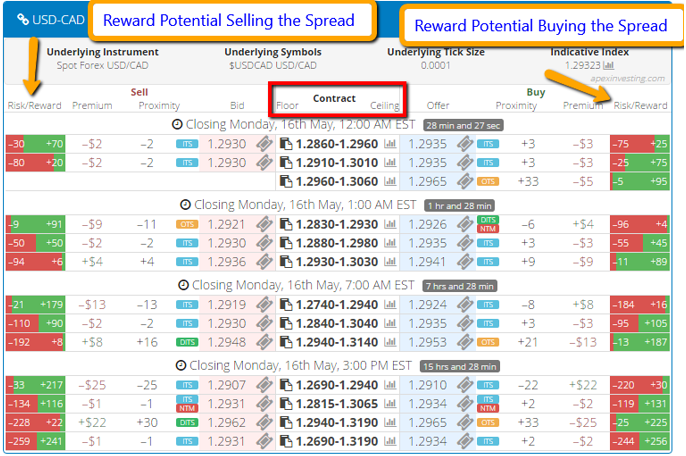

The market’s reaction to this news is unpredictable. The reaction it tends to have, however, is a move and then it can pull back. The Iron Condor uses two spreads: the lower one being bought below the market and the upper spread being sold above the market. This trade strategy is set up to make profit after the market has moved and retraced, pulling back to around where it started. The lower spread’s ceiling should meet the upper spread’s floor and be where the market is trading at the time.

How can the right spreads be found? Easily! By using the Spread Scanner, intuitively designed to easily learn how to trade spreads, as well as fast accurate execution. At a glance, a new trader can spot the right trades for a strategy.

This trade setup calls for each spread to have around a $15 or more profit potential. Once the browser based Spread Scanner is open, using the filters, the trader can pull up spreads for the desired markets. Each spread shows max risk and reward for both selling and buying. In this trade, simply find a spread to sell and buy with around a $15 or more profit potential, then verify the ceiling floor parameters. Clicking the ticket icon will open an order ticket. All parameters can be seen and checked and the order can then be entered. Below is an image of the Spread Scanner displaying various spreads for Nadex USD/CAD.

What if the market takes off and doesn’t pull back? In this case, stops are in place to keep risk realistic. Nadex spreads have capped, defined risk with the floor and ceiling points. Depending on which direction the spread is traded, there is no profit or loss beyond the floor and ceiling. With a combined profit potential of $30 or more, for a 1:1 risk reward ratio, stops should be placed 60 pips above and below from where the market was at entry. By doubling the combined profit potential of an Iron Condor, the stop points can easily be determined. To profit, the market simply needs to pull back or be between the two breakeven points at settlement. The breakeven points are the number of pips up and down, determined by the combined profit potential. For this trade, those points would be 30 pips up and down from where the market was at entry.

Free access to the Spread Scanner is available to all traders, as well as free day trading education at www.apexinvesting.com.