By Darrell Martin

This week is full of news events that generate volatility in the market. The number one is the Brexit vote on Thursday, based on whether the UK should stay in the European Union. This alone will be enough to generate big, fast moves in the currency markets. With the current market conditions, it is wise when trading to trade Nadex with defined capped risk. Traders in the spot Forex markets could get margin calls. There are never margin calls trading Nadex. Wednesday, June 22, 2016, Canada comes out with Retail Sales and Core Retail Sales. Typically, based on previous releases, this event can be traded with an Iron Condor strategy using Nadex USD/CAD spreads.

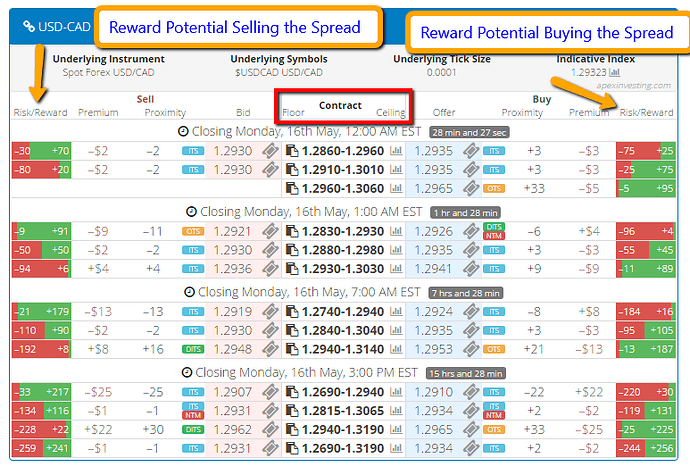

To set this trade up, buy a spread below the market with the ceiling of the spread where the market is trading at the time. Also, sell a spread above the market with the floor of the spread where the market is trading at the time. The ceiling of the bought spread should meet the floor of the sold spread and be where the market is trading at the time of entry.

The news comes out at 8:30 AM ET, so entry can be as early as 8:00 AM ET looking for 10:00 AM ET expirations. Each Nadex USD/CAD spread should have a profit potential of $15 or more. If implied volatility (IV) is high due to the week’s events, spreads with higher IV may be found, which is fine. For stops at a 1:1 risk reward ratio, simply double the amount of the profit potential of the combined spreads. That is the number of pips up and down to place the stop limit orders.

This is a premium collection trade strategy. Typically, the market reacts after this news, makes its move and then pulls back. The Iron Condor strategy is set up to collect the premium built into the pricing from the implied volatility. As time moves closer to expiration, the trade collects premium as long as the market is close to the center where it started from between the two spreads. The breakeven points are determined by the total amount of profit potential. That is the number of pips up and down, which the market can move and the trade will be profitable. If the market moves past those points, then there will be a loss.

Traders looking for an easy way to find the right spreads should use the spread scanner designed specifically for trading Nadex spreads. The scanner can display all the necessary information in one window allowing for quick, accurate decisions on spread choices. See below for a layout of the spread scanner.

Free trading education and access to the spread scanner is available at www.apexinvesting.com.