By Darrell Martin

Two reports for Canadian employment news will be released Friday, September 9, at 8:30 AM ET. One tells of the change in the number of employed people in the previous month. The Unemployment Rate gives the percentage of total work force that is unemployed. This rate is thought of as a lagging indicator. Employment overall is tied to consumer spending which is an important indicator for economic health.

Together these reports have an impact on the market. The market usually makes a move and then, after the move, will start to pull back. That kind of movement makes for an Iron Condor opportunity, where the strategy will profit when the market pulls back to where it started, making it neutral or ranging.

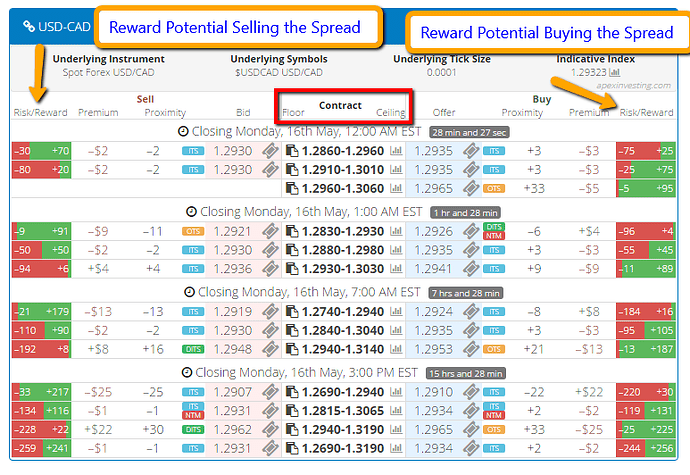

To set up for this trade, buy a Nadex USD/CAD spread below the market with its ceiling where the market is trading at the time. Another spread would be sold above the market with its floor where the market is trading at the time. The trade can be entered as early as 7:00 AM ET for 9:00 AM ET expirations.

Each spread should have a profit potential of around $17 for a combined profit potential of $35 or more. When the market settles anywhere between the breakeven points of 35 pips up or down, there will be some profit, with max profit being when it is between the two spreads at settlement. Should the market go beyond the breakeven points, stops should be in place. For this trade, the 1:1 risk reward ratio points and the points where stops should be placed are where the market would hit 70 pips above or below from where it started.

The spread scanner designed by traders to better trade Nadex spreads efficiently and effectively, can be used to filter out the USD/CAD spreads expiring at 9:00 AM ET. Then, a quick look down the reward columns tells which spreads have the right profit potential. Just verify the floor and ceiling info and max profit on the ticket and place the trade. Stops can be set as well. Below is a view of the spread scanner.

For free access to the spread scanner and free day trading education, go to Apex Investing.