By Darrell Martin

What do refrigerators, computers, cars, and airplanes have in common? They are all considered durable goods, a hard product with a lifespan of three or more years. Tuesday, April 26, 2016, at 8:30 AM ET, US Durable Goods and Core Durable Goods news will be released, thus revealing the total value change of purchase orders with manufacturers. Core Durable Goods will exclude the order information for transportation items such as autos and airplanes.

This news can be ideal for trading EUR/USD using Nadex spreads and an Iron Condor strategy. Typically, this market tends to react and move to this news but then pull back. An Iron Condor strategy uses two spreads to capture profit from the market when it starts out in a place and returns to that general place or stays in the range. A Nadex spread is a day trader option that gives the trader an opportunity to trade a specific market, within a defined range, designated by a floor and ceiling number within the market. The market may move beyond the floor or ceiling, but will not profit or lose past those points and can be traded long or short. Spreads also have expiration times. For this trade, you can enter as early as 8:00 AM ET for 10:00 AM ET expirations.

The Iron Condor is set up with two spreads trading specific ranges of the market: one on top and one on the bottom. Buy the Nadex EUR/USD lower spread with the ceiling where the market is trading at the time. Sell the Nadex EUR/USD upper spread with the floor where the market is trading at the time. The spreads should have a $30 or more combined profit potential, meaning each spread should have around a $15 profit potential.

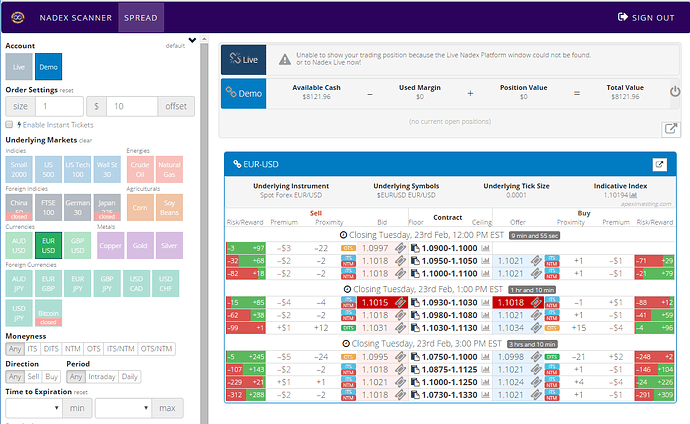

Using the spread scanner, you will easily find the right spreads. Login to your demo or live Nadex account. Next, go to www.apexinvesting.com and open the spread scanner. Choose the EUR/USD market. A window will open with all the available spreads. Find the ones expiring at 10:00 AM ET. Then, look to the left side and right side of the window. There you will see risk/reward potential. Find the spreads that meet the risk/reward potential and the floor and ceiling parameters should meet up as well. Click on the ticket icon, fill in your order information and you have made your Iron Condor trade. For an example of the scanner, see below.

The advantage with this strategy having a spread below and above the market price is that it won’t matter which direction the market moves. The market can react one of three ways and you will profit. It can move and then pull back, it can stay in a range within the breakeven points of your trade, or it can stay and not move at all. Max profit is when the market is right between your spreads at expiration time. The breakeven points will be 30 pips up or down from where the market started. It is imperative to manage risk, as well. The max risk of this trade is not the realistic risk. To exit and manage risk, exit if the market moves approximately 60 pips up or down, depending on your exact entries. That is where the 1:1 risk reward ratio points would be. The market has a 60 pip total wide range to move around where the trade can still make some profit, and a 120 pip total wide range before losing more than a 1:1 ratio.