By Darrell Martin

What are binary options? How do you trade them? How do they work? If binary options trading is something you are considering, these questions may have crossed your mind.

Binary options are short-term fast moving contracts with only two possible expiration/settlement values: $0 or $100. At expiration/settlement, because a binary option is a true/false statement, either the event happened or it did not happen. When trading binary options on Nadex, your position can be held until expiration or exited early to protect your profits or cut your losses.

Nadex binary options have defined capped risk. There are no stop outs or whipsaws. Your defined risk is known before entry and you cannot lose more than the defined risk. The maximum risk is the initial trade cost, which means there will never be a margin call.

Binaries are settled at cash value of the option, which means no delivery of physicals such as stock certificates, gold or soybeans. They open and expire at a certain time.

Strikes and Statements

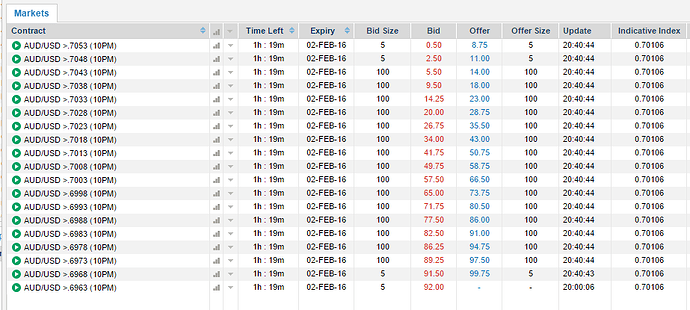

The image below shows many different strikes available for AUD/USD expiring at 10PM ET. Each number listed after AUD/USD is a strike price. Each one is a statement.

For example, look at AUD/USD >.7003 (10PM). It says that the AUD/USD will be greater than .7003 at 10PM. If you agree with the statement, you think it is true and you buy. If you do not agree, you think the statement is false and you sell.

Risk/Reward

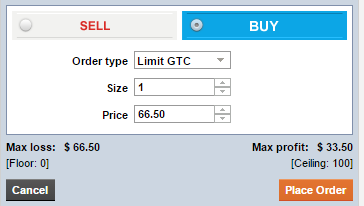

Continuing with the same example, if you BUY one Nadex binary, according to the above image, the offer/buy price is $66.50. Your max risk would be $66.50 and your max reward would be $33.50, which is the amount you risked ($66.50) subtracted from $100.

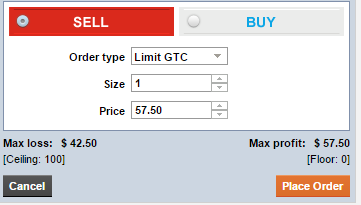

If you SOLD one Nadex binary, the bid price is $57.50. Your max risk would be $42.50, and your max reward would be $57.50. The risk when you sell is figured by subtracting the bid/sell price from 100, and the max reward is the price you put up to enter the trade. The bottom of the Nadex ticket automatically figures this for you.

Probability

Binary options have nothing to do with price per tick. They are all about probability. The lower priced binaries may look like a great deal, but they have a higher risk because, like their lower price, they have a lower probability of the statement being true.

If you buy, for the statement to be true at expiration/settlement, the indicative price must be above the strike price, not equal to it. If you sold, you profit when at expiration/settlement the indicative price is at or below the strike price. Make sure you have a system you are using along with charts and indicators.