By Darrell Martin

Most traders will tell you they hate a choppy market. The attitude regarding chop is a little different at Apex Investing Institute. Depending on the strategy, chop is loved!

Chop can be a signal that something is building up and about to happen. It does not mean that you want to trade the chop itself, but when chop is noticed and identified, you can wait for a break out- a time for a possible entry into a trade.

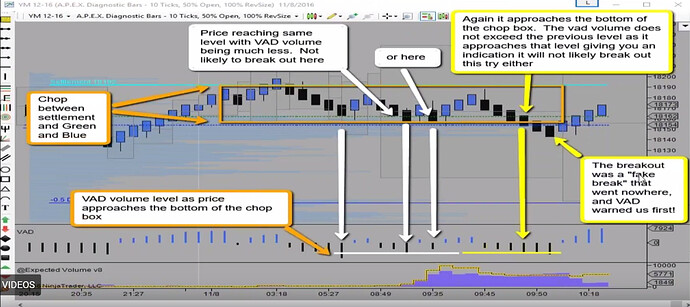

During any trading day, there are key levels that draw the movement of the market. These can include settlement, deviation and ICE levels, as well as other levels. In the following image, the market is choppy. It is bouncing between the blue and green ICE and settlement levels.

Apex utilizes an indicator, which measures the accumulation of volume in a trend. It allows you to see the strength of a trend or when a trend is dying out. It is known as VAD and is shown in the image towards the bottom of the chart. Chop is marked with a box around it. Notice when the market broke out of the chop box, VAD didn’t exceed the highest amount of volume as it had while in the chop box.

Sometimes, as traders attempt to trade the chop breakouts, they are hit with the fake breakouts. When looking for the breakout trades, you’re not looking for a little bit or even the same amount of volume. When the market breaks out of the chop box, look for volume that exceeds all the volume shown earlier in the chop box. Doing so will protect you from a fake breakout.

As the market attempted its breakout, you wouldn’t have been the tempted to go short because by looking at VAD, you would have known that the volume wasn’t strong enough for the trend to continue going down. When volume was exceeding, it was easy to see that it was building steam.

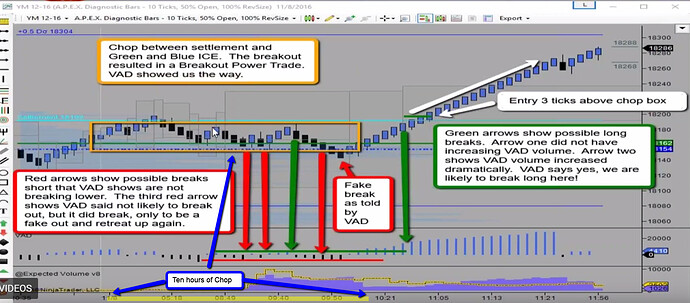

When the market is bouncing between strong levels, you can expect that it will break through the opposite direction with a fake breakthrough, then reverse with a lot of steam and take off. This makes up a strong, quick binary strategy, which identifies the levels, the chop area and the accumulated volume. It is very powerful.

The chop shown in the image below was over a period of 10 hours! Notice that once the market made the break with the correct amount of volume, it moved quickly.

Keep in mind that if you trade Binary Options on Nadex, you know they have hourly expirations. Suppose this move out of chop happened at 10:45. Many times, as the market attempts to pass through a key level, it will try again to pull back to that level. This is where you will see the longer wicks on the bars. It was true in this case, but because of the volume, the market had the power to continue moving up. If you had bought the next expiring binary, you would have missed out on most of the move. However, the little pull backs allow you another chance to get into the trade if you missed the initial entry.

When contemplating using this system with binaries, you would want to buy an ATM (At The Money) binary option. You can expect a little pull back in the market, especially if you are looking at a binary with an expiration that closes soon. It would probably be better to choose the next further out binary, giving you more time to be right.

With this powerful system, there is more to it than just learning the indicators on the charts. You have to choose the right binary. You don’t want too close or too far of an expiration on the binary. You don’t want to buy the daily binary with the expiration that is five or six hours out because the value is going to move very slowly. Select a binary with an expiration that will allow the value to move fast enough to take advantage of the move, but have sufficient time to make the move and not have it pull back against you.

The ideal way to trade this strategy, using the indicators for backup confirmation, is to enter between 30-45 on a buy and 70-55 on a sell. Set your take profit order at a 1:1 ratio. Do not hold it until expiration. Get in, double your money and get out. Keep in mind the more time until expiration, the slower the value is going to move. You want at least 20 minutes until expiration, although 30 minutes or more are preferred.

Make sure you have plenty of time to be right with quick movement of value. Have a good risk/reward ratio. Take the time to study the strike ladders to learn what moves faster and check all your options. Learn how OTM (Out of The Money), ATM (At The Money), and ITM (In The Money) Work. Let all of these things work to your advantage.