By Darrell Martin

Friday, May 4, 2018, at 8:30 AM ET, the Nonfarm payroll report, along with the Unemployment report will be released. These reports detail the changes in the workforce in the United States. If people are not working, they are not spending as much, which influences economic activity.

Last month’s unemployment rate was 4.1percent. It is forecast to change slightly to 4.0 percent this month. Nonfarm payrolls were 103,000 last month expecting to grow to 192,000 this month. Both of these reports cause movement in the market and can be traded. A higher than expected reading for Nonfarm payrolls should be taken as positive or bullish for the USD, while a lower than expected reading is regarded as negative or bearish for the USD.

The Unemployment rate report is opposite. A higher than expected reading should be taken as negative or bearish for the USD, whereas a lower than expected reading would be considered positive or bullish for the USD.

Two kinds of strategies using Nadex spreads are recommended for this news event. The first is an Iron Condor and the second is a Straddle. Nadex spreads allow traders to trade long or short a range of the market with a bottom and top or floor and ceiling, as they are called. Traders cannot lose or win past the floor or ceiling depending on trade direction. It is simple to set up a Nadex account and takes little time with only $250 for a live account. Be sure to demo trade and get it down before live trading.

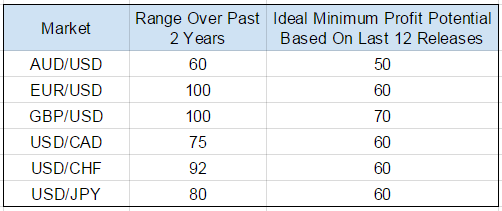

The report is released at 8:30 AM ET, with entry as early as 7:00 AM ET for 3:00 PM ET expirations. For an Iron Condor, buy the lower range spread below the market with the ceiling where the market is trading at the time and sell the upper range spread above the market with the floor where the market is trading at the time. Then, determine the minimum profit potential. Below is a chart listing all possible markets along with the ideal minimum profit potentials for the trade setup. The minimum profit, seen in the chart, is based on the ranges shown over the last 12 - 24 months.

Most of the movement happens in the first 15 minutes, so it is recommended to go for as much time as possible to give the market time to retrace. One side of the trade will most likely profit and then as it retraces and pulls back, the other side will profit. The iron condor setup can also be entered at 8:00 AM for 10:00 AM ET expiration.

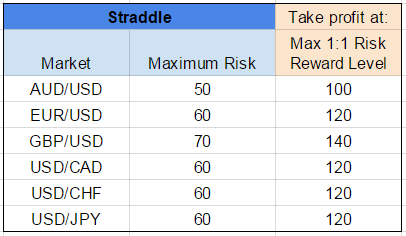

The next strategy set up is the Straddle. It is a little different. With this strategy, do the opposite of an Iron Condor. Buy a spread above the market with the floor where the market is trading at the time and sell a spread below the market with the ceiling where the market is trading at the time. When setting up a straddle, base it on maximum risk. Below is a chart showing the market and the maximum risk for the specific straddle. It also shows how many pips in either direction to take profit. With this setup, one side of the trade will lose but the other side will win, covering the loss for the other side.

These are the ranges expected or minimum profit in pips. If a straddle can be pulled off taking profit for 1:1 from the market price up to the expected move, entering at 7:00 AM ET for expirations at 9:00 AM ET, 10:00 AM ET, or 3:00 PM ET, that is acceptable and a better trade in many cases. Make sure to use limit take profit orders entered immediately after filled. Also, be very aware of deviation levels and take profit before the deviation level is hit. Remember, 90 percent of the time the biggest move has happened in the first 15 minutes.

After the Iron Condor and Straddle action takes place and the markets settle down, often the market will remain flat after 11:00 AM ET to 3 PM ET and on a Friday. This can be a great time for Butterflies using Nadex binaries.

For free day trading education as well as a news trading calendar, visit Apex Investing.