By Darrell Martin

On a Friday early each month, the US releases its Nonfarm Payrolls and Unemployment Rate reports, along with several other employment related reports. Because job creation is the foremost indicator of consumer spending, these reports can account for a majority of economic activity. Markets can react strongly to these reports causing the implied volatility present to offer trading opportunities for NFP Friday. These reports will be released Friday, March 9, 2018, at 8:30 AM.

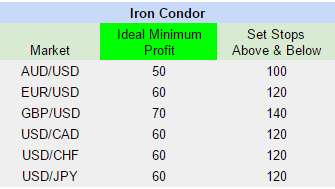

Utilizing Nadex spreads, Iron Condors can be set up for several markets. For example, in the chart below, GBP/USD has a combined potential of $70. Therefore, one spread is bought below with a minimum profit potential of around $35 with another spread being sold above the market with a similar minimum profit potential. The ceiling of the bought spread should meet the floor of the sold spread and be where the market is trading at the time.

Iron Condors profit when the market makes a reactionary move to the news and then makes a pull back. Max profit is made when the market pulls back to center between the two spreads.

See the chart below for combined ideal minimum profit amounts. In addition, stops should be set above and below from where the market was at entry. These stops reflect the profit potentials listed.

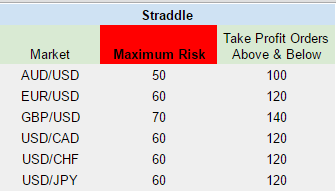

A Straddle using a 1:1 risk reward ratio can be a better trade. It is the opposite setup of an Iron Condor. Using AUD/USD as an example, one spread is bought with the floor where the market is trading with a maximum risk of $25. Another spread is sold with its ceiling where the market is trading, also with a max risk of $25. The ceiling of the sold spread meets the floor of the bought spread.

With a Straddle, the risk is low and doesn’t require stops. This type of trade does require take profit orders to placed just after entry. The table below shows the maximum risk. It also shows where to place take profit orders, both above and below based on that specific risk.

Ninety percent of the time, the biggest move happens within the first 15 minutes of the news release, but go for as much time as possible. Entry can be anytime between 7AM and 8:15 AM ET, for Nadex Spreads 9AM, 10 AM and 3 PM ET expiration times.

Stop orders must be set for Iron Condors and take profit orders must be set for Straddles immediately after entering. No need to be overwhelmed by news trades. Most often price leads news. Just be sure to enter with the minimum profit potential for the Iron Condor and stay at or under the maximum risk for the Straddle. This will give a high probability setup for each strategy.

A free news calendar with trade setups is available at Apex Investing.