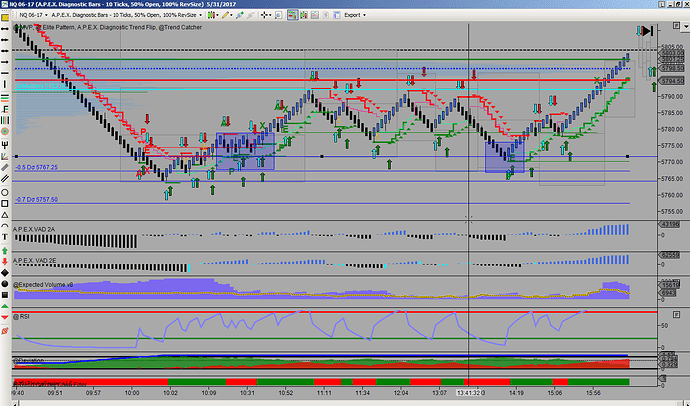

Can someone please explain to me how I could have known that larger traders (sharks) were going to push the market higher at 14:19 on my chart? It looked like the market was going to go down and challenge the low of the day but it stopped and reversed with some heavy buying volume. Did they drive the market down to the 5770 level to get those buy orders Why would there be a bunch of buy orders at the 5770 level?

While that is entirely possible.

You also had the -0.5 dev in addition to a fairly strong Izone that had been right with the -0.5 dev at the 5767 mark since about 10:30am EST. So most likely there was going to be a bit of a reversal.

Plus, there was the wrong information given for the Chicago PMI earlier in the morning… http://www.marketwatch.com/(S(rnrsydaynixa5x55oiibxm45))/story/economy-shifts-to-merely-fast-from-furious-in-chicago-area-pmi-finds-2017-05-31?link=MW_story_latest_news

So the market may have still been reacting to that.

There are a few clues that I think would have given you a heads up.

First, the Total Deviation move down as indicated by the “Deviation” indicator shows the market had already moved over a 1 deviation move down. Second you are hitting the -0.5 static deviation and always look for chop or potential reversal at a deviation most importantly a 1 deviation. Third, VAD 2A started showing a serious drop off in distributed volume and some divergence. Fourth the market started making higher lows. After the second higher low you get a flip to accumulated volume on VAD2E. That is a very likely reversal after reading all of that market context. After this the NQ returned to settlement and tested it unsuccessfully several times, eventually almost returned to the -0.5 but bounced where that major battle area occurred previously around the 10:09 time-stamp. The flip of the the MVP and the APEX pattern are also some really good confirmations of the other market context. Personally the total deviation and VADs are some of your more powerful indicators here and the rest of the indicators can indicate other entries.