By Darrell Martin

Whether you are buying or selling Binary Options, there are only two possible payouts at expiration: It is either $100 or $0 per contract.

When you enter a trade, you are saying that you believe either a statement will be true or it will be false. Trading binary options is as basic as putting your vote in for a true or false statement.

There are many markets and different scenarios that you can used to effectively trade using binary options.

As an example, let’s say you are aware of a news report coming out and believe it will affect the GBP/USD causing the market to be under pressure for the day. You check your charts and find a binary that backs up your conviction. Of course, there are no guarantees the market will move up or down or even be affected by a news report.

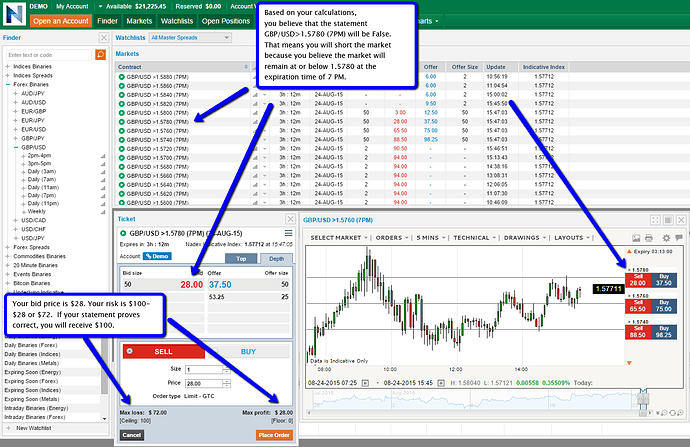

You believe the market will stay below the 1.5780 level at the expiration, so GBP/USD>1.5780 (7PM) looks like a good binary strike level to enter for your trade. Selling this binary, you are saying that the statement is false, or disagreeing with the statement of that particular strike by saying that GBP/USD will be at or below 1.5780 when the contract expires at 7 PM.

You enter the trade to sell the binary at the bid price of 28.

Your risk is if the binary pricing trades higher or the difference between your 28 trade price and 100, which is $72 maximum risk per contract. That is your initial trade cost, $72, which you probably think is a high portion relative to the expiration payout. The initial cost is higher because the underlying GBP/USD is already trading below the strike level. You are paying for the initial trade advantage.

Your profit potential, if the binary finishes in the money at expiration, is $28. Essentially, you are short the binary trade price at 28, so you want to have the binary expire at zero, thus the difference is your profit per contract.

If your binary finishes in the money at expiration, you will receive $100 per contract. If your binary finishes out of the money at expiration, meaning the underlying is trading higher than the strike level of 1.57801, you get $0, resulting in the full loss of the initial trade cost or $72 per contract in this example. (Note: exchange fees were not included in any of the calculations above.)

Remember you don’t always have to wait until expiration. You can close out your binary position prior to expiration to cut your losses or take an early profit.

It is important to be prepared for different scenarios by planning your trades before you enter. However, with binary options, you always know your max risk and profit on the trade before you place the trade.

Tip! When selling a binary option, the price you sell for is your potential profit. Your maximum risk is always the difference between your trade price and $100.