By Darrell Martin

The first time you placed an order for a binary option trade, you may have wondered why you were suddenly losing money. You bought or sold the right strike price and felt that you had a good reason for placing the trade. How can you understand profit and loss on binary options? Why does the profit and loss column show that you are losing?

This is a valid question for any trader, seasoned or just starting out. In order for any profit to show, the strike must first overcome the bid/ask spread. What is the bid/ask spread? It is the difference between the bid (sell) price and the ask (buy) price.

For example, as soon as you enter your order for a sell, your profit/loss (P/L) would show an immediate loss because if you were to get out of your sell trade, you would have to execute a buy order. In order to do that, you would have to use the buy price, which is higher than the sell price and that would cause you to lose money to get out of the trade.

For your trade to show a profit, the buy price must go lower than the original sell price. When this happens, you will see a profit in your P/L section of your platform.

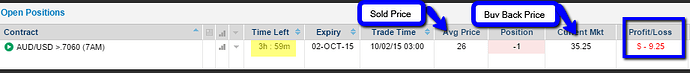

Let’s look at an example.

This shows that one contract of AUD/USD >.7060 (7AM) was sold at 26. The current market or price to buy it back is at 35.25 resulting in an immediate loss of $9.25 as shown in the Profit/Loss column. This trade has nearly four hours remaining for the current market to drop below the original sell price, at which time the trade would become profitable.

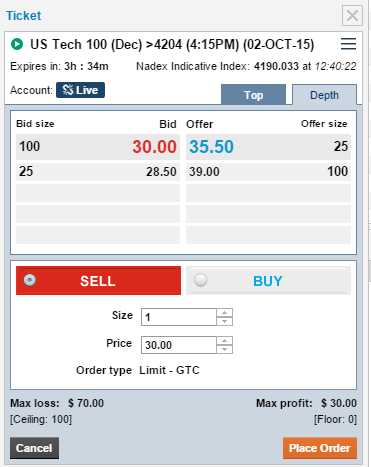

Here is another example. This time showing a ticket that would be displayed when you enter an order for a trade.

The ticket shows that one contract of US Tech 100 (Dec) >4204 (4:15) will be sold for 30.00 (bid). The offer or ask price is 35.50. If you were to sell this contract, you would have an immediate loss of $5.50 until the buy (offer, ask) price drops below the price you at which you sold (bid). Once the buy price drops to 30, you would be at breakeven. After that, you would begin to see a profit in the P/L column on the open positions of the trading platform you are using.

If you were to enter a buy trade, for example, buying at the current ask price of 80 with the current bid price of 75, you would likewise show a loss of $5 because you would have to execute a sell order to get out of the trade. Once the sell (ask, offer) price moves up to your original buy price, you would be at breakeven; when it passes that point, you would then see a profit in the P/L column.