By Darrell Martin

The Census Bureau will be releasing numbers this week, Tuesday to be specific, on US Building Permits and Housing Starts. The last set of numbers was a mixed bag. While the number of building permits went down in July from June, housing starts had gone up, hitting the highest level since February. Expectations are that housing starts will rise for August. However, the big news is due out Wednesday, with the Fed’s rate decision and statements for September. Building news and last week’s news together will no doubt influence Yellen’s decision Wednesday for a rate hike now or possibly later in December. In the meantime, Tuesday’s news, being released at 8:30 AM ET, waits for trading.

Typically, market reaction for these two events is a move and then a pullback. For this kind of move, an Iron Condor trading Nadex spreads is a strategy that is neutral and profits when the market ranges, pulls back to where it started from, or simply doesn’t move at all. Trading Nadex EUR/USD spreads, the trade can be entered as early as 8:00 AM ET for 10:00 AM ET expiration.

A neutral strategy is one prepared whether the market moves up or down. To set up for that scenario, buy a spread below the market with its ceiling where the market is trading at the time and also sell a spread above the market with its floor where the market is trading at the time. For this trade, each spread should have a profit potential of $15 or more for a combined profit potential of $30.

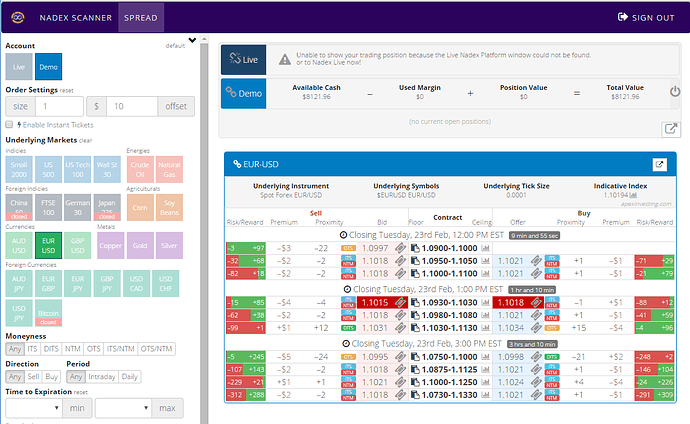

Traders familiar to trading Nadex spreads have found the Apex spread scanner makes trading spreads much simpler and their execution faster. Setting up for an Iron Condor, looking down the reward columns for adequate profit potential for the trade, is an easy way to find the right spreads. Then, one only needs to verify the other parameters before entering the trade. The spread scanner risk/reward columns can be seen in the image below.

Spreads have capped risk, as there is no loss beyond the floor or the ceiling as determined by the direction the spread is traded. To further make the risk more realistic and keep it to a 1:1 ratio, stops can be placed. For this trade, the stops should be entered where the market would hit 60 pips up and down. The breakeven points are 30 pips above and below. When the market settles between those points, profit will be made. The Iron Condor achieves max profit when the market settles right between the two spreads.

Free access for all traders to the spread scanner as well as free day trading education is available at www.apexinvesting.com.