By Darrell Martin

The Capacity Utilization Rate and Industrial Production numbers will be out Tuesday, May 17, 2016, at 9:15 AM ET. The two reports can cause the EUR/USD market to move, making a trade opportunity. To know which way the market will move is the challenge when trading the news. Using a strategy that has the possibility to profit whichever way the market goes, becomes key to selection.

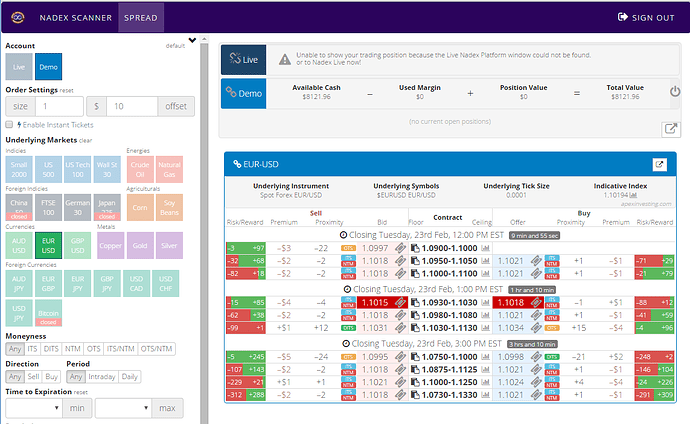

The Iron Condor strategy is set up to capture profit regardless of market direction. By trading two Nadex EUR/USD spreads, buying one and selling another, the strategy is prepared. Buy a spread below the market but with the ceiling where the EUR/USD market is trading at the time. Also, sell a spread above the market but with the floor where the EUR/USD market is trading at the time. Entry can be as early as 8:00 AM ET for 10:00 AM ET expiration.

This strategy is good for when it is anticipated the market being traded will make a move and then pull back. If the market pulls back to where it was when it started to move and when the trade was entered, that is ideal. The profit potential for this trade is $30 or more combined between the spreads. Each spread should have a profit potential of around $15 or more. The spreads can be easily found by looking for spreads with the right profit potential. Then simply verify the ceiling and floor parameters and the spreads for the strategy are found.

Should the market pull back to where it was after it has reacted to the news and made its move, the trade makes full profit. The breakeven points of the trade are where the market hits 30 pips up or 30 pips down. The market being anywhere between those two points at expiration means the trade has made some profit.To manage risk, use stop limit orders. Place one above where the market would hit 60 pips above and one 60 pips below from where it was when the trade was placed. Those points are the 1:1 risk/reward ratio points. Remember, more contracts can be traded just be sure to buy the same number as is sold.

Always demo the trade first with a Nadex demo account. The spread scanner can be found at www.apexinvesting.com along with free education.