By Darrell Martin

The Fourth of July, known as Independence Day for the United States is fast approaching. Any holiday in the US can make for slower low volume markets. During these times, trade opportunities may be available around scheduled international news events. Sunday evening July 2, at 11:00 PM ET a straddle trade can be entered for the UK Manufacturing Purchasing Managers Index news out Monday morning in the wee hours of 4:30 AM ET.

This report released monthly has been known to cause the GBP/USD market to make some big moves. Based on previous market action to past reports, a straddle strategy trading Nadex GBP/USD spreads with a maximum risk of $40 combined for the trade, was found to be a high probability trade.

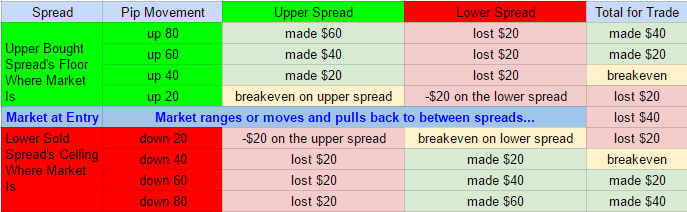

Buy one spread with a maximum risk of $20, having the floor where the market is trading at the time. Sell another spread with the same max risk and its ceiling where the market is trading at the time. This setup is poised to profit for a large move up or down. To take profit, enough to cover the total risk and a 1:1 risk reward ratio, place take profit orders where the market hits 80 pips above and below from where it was at entry.

Once the market reaches 40 pips above and below from entry, the max risk has been covered. To see a visual for each spread showing the profit and loss made for each 20 pips of market shares in one direction, see the chart below.

The straddle strategy is great for low risk, to enter ahead of time, such as the night before and can profit whichever direction the market moves. Entry for this trade is 11:00 PM ET Sunday evening for the 7:00 AM ET expiring Nadex GBP/USD spreads. If the US is on holiday, just look for some international news to move the markets.

For free day trading education and access to the pro spread scanner visit www.apexinvesting.com.