By Darrell Martin

On Friday, February 16, the US will release various tradeable reports at 8:30 AM EST. These reports include Housing Starts, Building Permits and Import Prices.

These reports have the capacity to cause some volatility in the market, thus presenting a possible trading opportunity. Because of the volatility, traders know there will be movement in the markets, but the direction of the market is unknown. Since the market will move, an Iron Condor strategy allows for movement, but also expects a pullback.

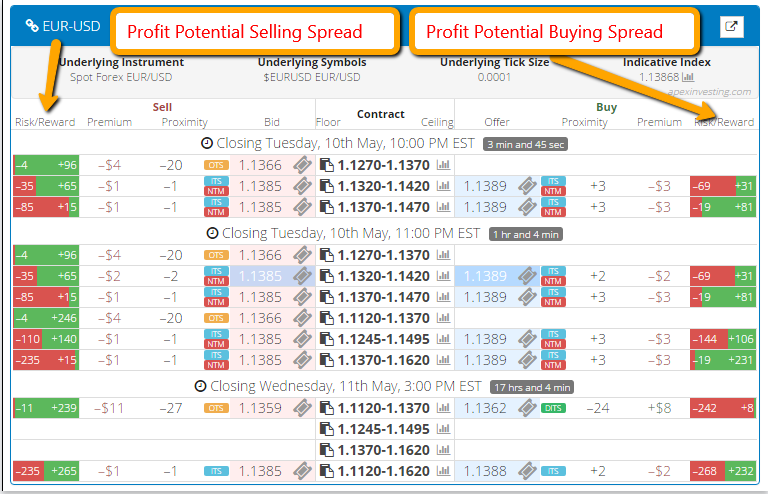

To set up this trade, look for two EUR/USD spreads. Simultaneously, one is bought below the market while another spread is sold above the market. The ceiling of the bought spread should meet the floor of the sold spread and be where the market is trading at the time of entry. This allows the market plenty of room to move and pullback to make a potential profit.

Enter as early as 8:00 AM EST using 10:00 AM EST expiration contracts. The minimum profit is $35 meaning you will want at least $17 of profit potential on each spread.

Using the spread scanner makes it easy to find the spreads for the potential trade. If the parameters of the trade cannot be met, there is no trade. Never force a trade. The image below illustrates profit potential on the scanner for EUR/USD spreads.

Remember, when trading with Nadex spreads, risk and profit is capped at the top and bottom of the range of the spread. The risk and reward are always known up front before any trade contract is entered.

To learn more about trading the news, visit www.apexinvesting.com.