By Darrell Martin Using the Nadex Strike Ladder for trade management may seem a little absurd. Isn’t it just a tool used for choosing a binary strike price and placing your trade? As well as being extremely useful for placing your trades, the strike ladder can help with other aspects of trading.

In other articles, the importance of knowing what strike is at the money (ATM) was discussed. Identify the ATM binaries, and the in the money (ITM) and out of the money (OTM) strikes are known as well.

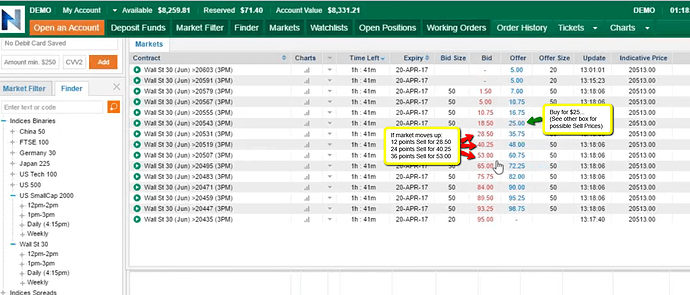

Utilize other information readily available on the strike ladder. Think beyond the binary settlement of 0 or 100. For example, look at the strikes listed for YM (Wall St 30, Dow Futures mini underlying). They have a difference of 12 points. If you want to focus on short-term trades, you could determine the buy or sell price of your chosen strike if the market moved up or down 12 points.

The same stands true for each 12-point move made i.e., 12, 24, 36…. As time gets closer to expiration, the prices are going to move much more quickly.

The image above shows that if you buy one strike and the market moves up one, two or three strikes, sell the contract for the price shown in the bid column one, two or three levels down the ladder. For short-term trading, this displays the potential profits for a shorter time.

Perhaps, because of an upcoming news event, you know the market is going to move. The strike ladder helps you see the potential profit, should the market move up a strike or two or even three!

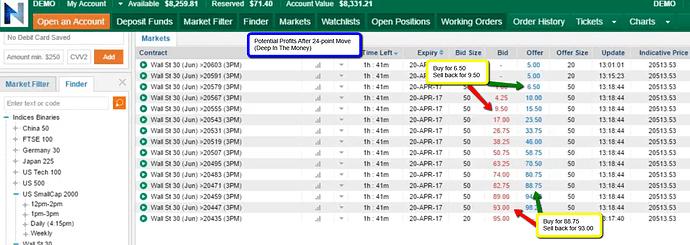

Be cautious when considering deep in the money transactions. Deep in the money (or deep out of the money) are those strikes significantly above or below the market price of the underlying asset.

Suppose you bought a contract for $6.50. By consulting the strike ladder, you can see that even if the market moved 24 points, your profit potential would only be $3. Consequently, not a very good ROI. The same is true on the other end of the strike ladder. You may buy for $88.75 and sell back for $93.

Notice that towards the middle of the ladder, profit potential is around $20. As the strike moves farther away from the center, the amount of profit is less the closer it gets to 0 or 100, or the closer it is to being ITM and OTM. Furthermore, the middle strike prices have the higher dollar amount differences between them. If the market moves 24 points in a short time, you have time and price working in your favor. Therefore, if you are considering a strike price that is OTM, but close to the middle of the strike ladder, it will require movement to become ATM. Then, time is required instead of movement, to stay above that level.

In summary, remember to look at this as a percentage and not just a dollar amount. Consider the binary price as a percentage or chance of it settling in the money. By using the strike ladder in this way, you can have a better idea on what your strike will be worth whichever way the market moves. Finally, this will help you in planning and executing the entry and exiting of your trades. Thus, this offers another avenue of risk management.