By Darrell Martin

Manufacturing and Industrial Production numbers, as well as the Goods Trade Balance for the UK, will be released Thursday, August 10, at 4:30 AM ET. This makes for an evening trade, which can be entered the evening before, as early as 11:00 PM ET on Wednesday, using capped risk Nadex GBP/USD spreads.

Based on previous market moves in reaction to this scheduled news event, it was found that the market can make a move and then pull back. To trade that kind of move, an Iron Condor strategy works well. One spread is bought below the market with its ceiling where the market is trading. Another spread is sold above the market with its floor where the market is trading. Said another way, the ceiling of the bought spread, the floor of the top spread and the market should all meet. To ensure this, each spread should have a profit potential of around $17 or more, for a combined minimum profit potential of $35 or more for the trade.

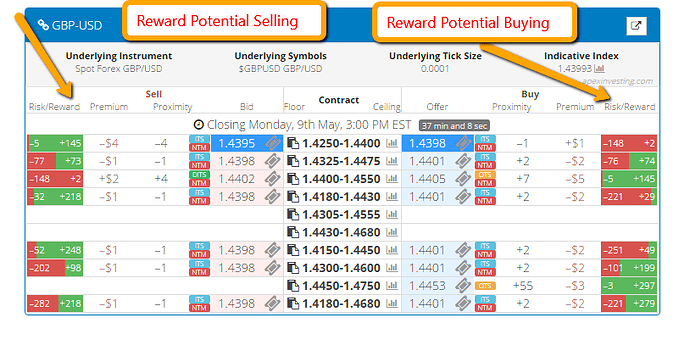

The spreads can be easily identified using the Apex Spread Scanner Pro designed specifically to quickly scan through and choose the best Nadex spreads for any given strategy. Using the spread scanner filters, click the GBP/USD market for expiration times at 7:00 AM ET. Then look to the red and green bars showing the risk reward for each spread, whether buying or selling. As stated above, the reward potential should be $17 minimum for each spread. See the example screenshot of the scanner below.

Once the trade is set up, stops can be placed to keep risk realistic. Risk is already capped; stops will keep it to a 1:1 risk reward ratio. If the trade’s profit potential is $35, simply double it to know where to place stops. For this trade, stops should be placed approximately 70 pips above and below from where the market was at entry. If the market takes off and goes beyond those points, then the total risk is only $35. The market need only to settle within the breakeven points of the trade to profit. Those points are 35 pips above and below from where the market is at entry.