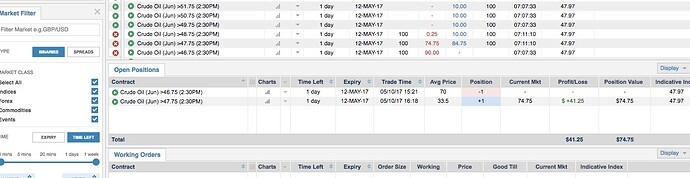

I have a butterfly position entered into yesterday. This morning the sell position after a few minutes went blank.

What does this mean?

Should I try to buy and exit this leg of it?

I believe crude oil is going up. But will it continue until tomorrow @ 2:30? I believe so.

It’s back now… this is a demo account BTW.

Still wonder what that meant and if I should hang tight or try and exit the “sell” leg.

That just means that there are no quotes available for that contract at that moment. Also, that looks more like a strangle than a butterfly. I would just hold onto it until it expires at this point. You never know, the market could come all the way back down for you.

Peter

Hi timelord914,

Thanks for answering.

I thought a butterfly was selling the strike above the underlying market and buying below the underlying market… and a strangle is buying an OTM binary above and selling an OTM binary below, in a market with high volume.

I would appreciate clarification as you are way more experienced.

I am trying to learn a few simple strategies well and trying them out.

Thank you!

1 Like

Yes you have that correct in your definition. But looks like you did it backwards here. For example you sold at $70. Which is an OTM contract with a $30 risk. That is an OTm contract. To do a butterfly you would have needed to buy for $70, and sell for $30

In the example above, the contract you sell should have been above the indicative, meaning it would have been priced close to around $25 sell, not a $75 sell. So you actually sold the contreact BELOW the indactive  Just keep in mind when you SELL for $70, that is an OTM contract with a $30 risk. So your set up here was a strangle, looking for big moves in the market. With a butterfly you are using both sides with an ITM contract and not expecting much of a move. Make sense? Just have to keep it straight in your mind the difference of a $70 buy and a $70 sell, completely different contract types ITM and OTM

Just keep in mind when you SELL for $70, that is an OTM contract with a $30 risk. So your set up here was a strangle, looking for big moves in the market. With a butterfly you are using both sides with an ITM contract and not expecting much of a move. Make sense? Just have to keep it straight in your mind the difference of a $70 buy and a $70 sell, completely different contract types ITM and OTM

1 Like

Thanks skeltonmark… my mind is twisted around for sure now! I will contemplate this and be more careful.

Just when I think I’ve got it! LOL

I ended up selling the one leg earlier… still feeling out my risk nerves and trying to pretend this demo money is my own little 500.00 and not 25,000!

May I ask another question? Ok, So, I saw that I had 25+ dollars profit in the Crude oil binary left in the now understood strangle and assumed that I could take the profit instead of riding it out until expiration.

I originally bought the CLM7 for 33.50 and then put in a working order to sell it at 57.50, which was picked up. Doesn’t that mean I made a profit of $24.00, less fees? I am not seeing it in my balance.

Appreciate your reply. These are probably really simple questions, but I am trying to see the workings.

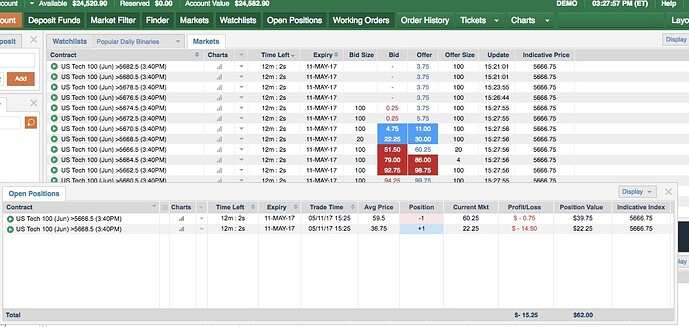

So is this a strangle? I bought at 36.75 OTM above the indicative of 5666.75 and sold it for 78.00

I sold an OTM at 59.50 ... and then bought it for 99.75...

My balance shows a loss of 3.00. What did I do wrong? Help! I am determined to figure this out!

(P.S. I have no idea why the formatting shifted)