I have been asked to post the rules I follow for doing 5 minute butterflies on Nadex. I will post the rules, charts and my trade history for last week. If there is enough interest I will post my trade history on a weekly basis. Feel free to comment and critique.

Rules for 5 Minute Binary Butterflies

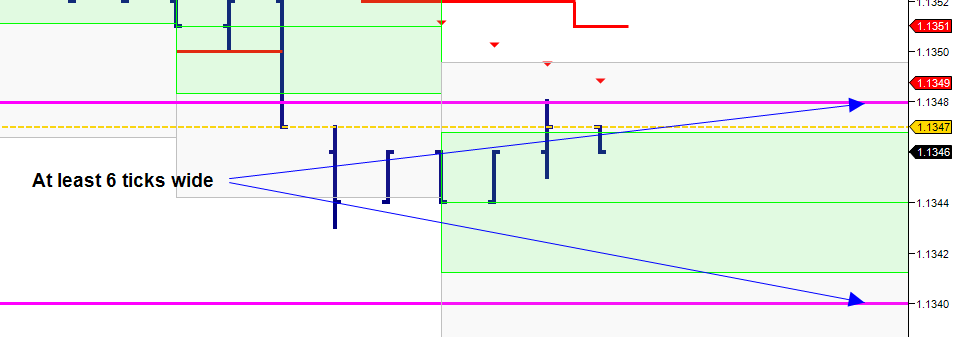

- Try to find strikes as close to the outside edge of the high/low expected range

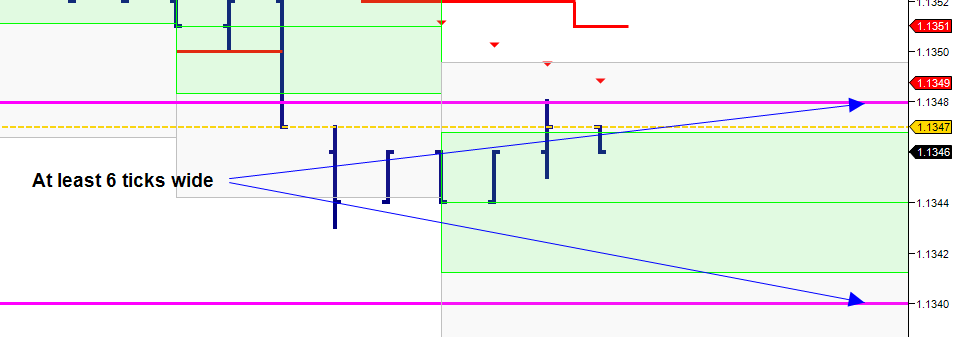

- Butterflies need to be at least 6 ticks wide

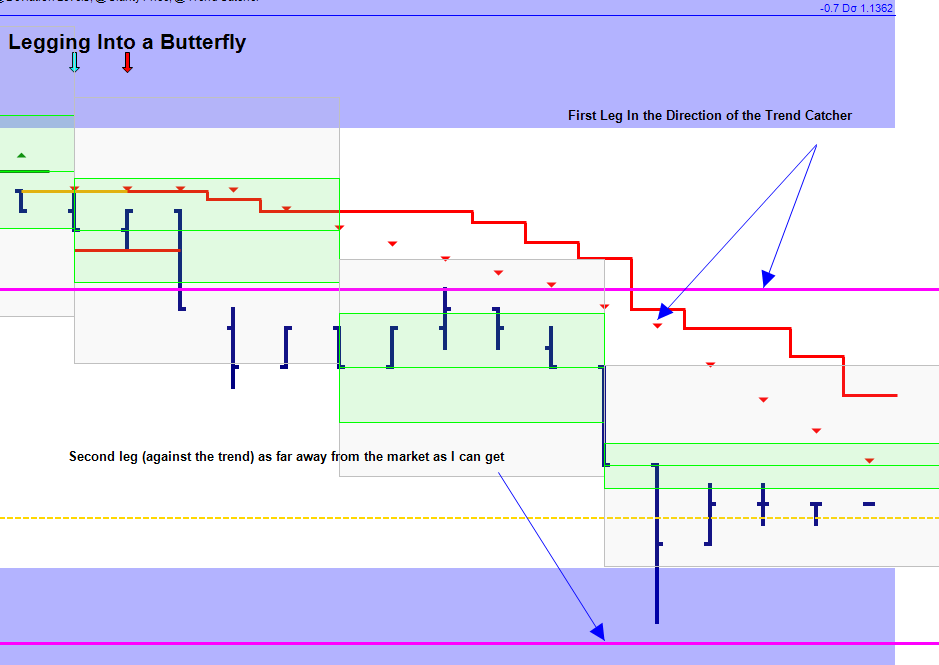

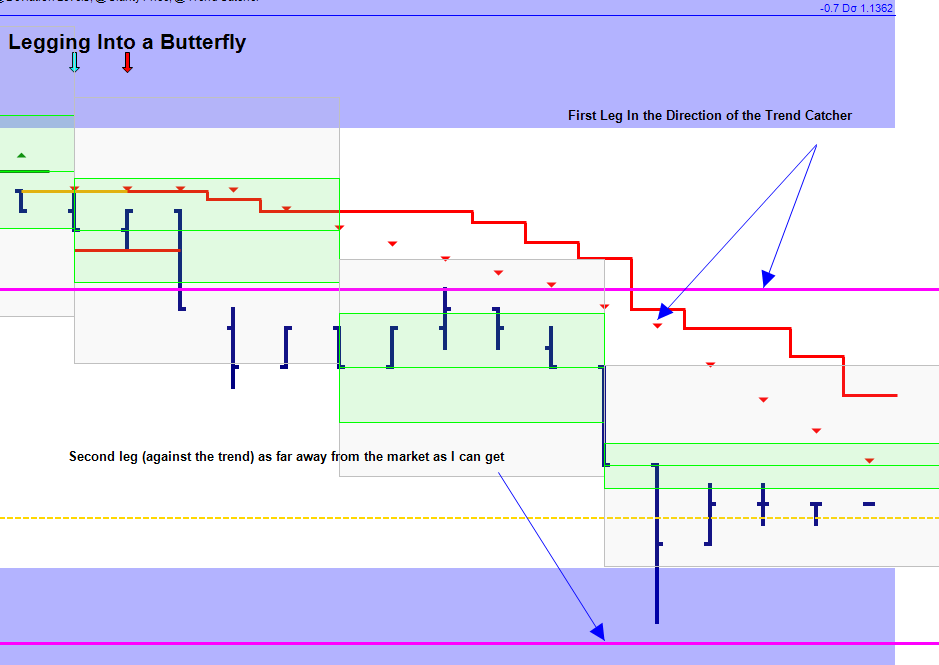

- I try to enter into both legs of my butterfly at the same time. However, most of the time I have to leg in. When I have to do this I ALWAYS enter the leg that is in the same direction as the trend catcher signal first. I want this leg to be at least three ticks away from the market. I will then find a strike for the against the trend leg as far away as I can.

Note: Anytime I take a butterfly I look back at the history, maybe the last hour, and see how much the market has been moving. If the market is fast and moving a lot I stay out or I will just enter the legs that are with the trend catcher. I also like to setup my strikes on the other side of the deviation levels. These work great as buffer zones.

Note: Never trade these during the news, UNLESS, Darrell says otherwise…lol

For exiting I have two strategies

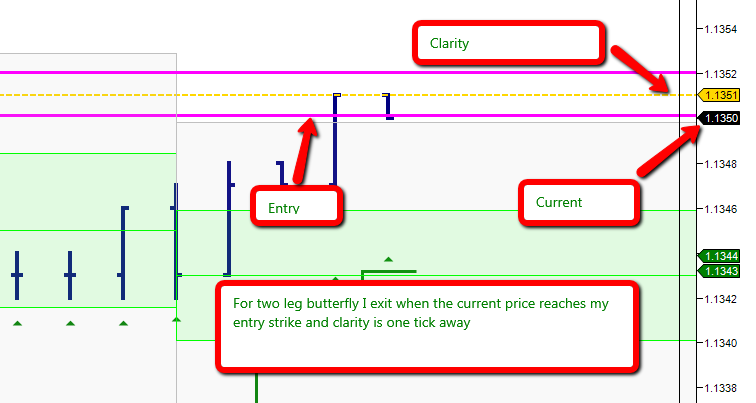

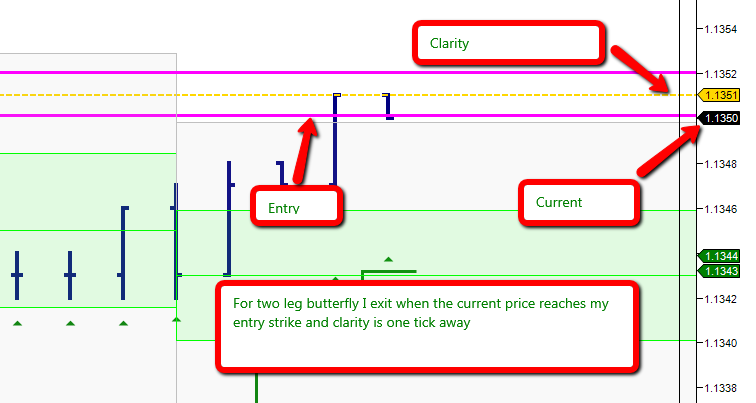

- When you are entered into both legs, I exit when the current price has reached my strike and clarity price is one tick above/below my strike.

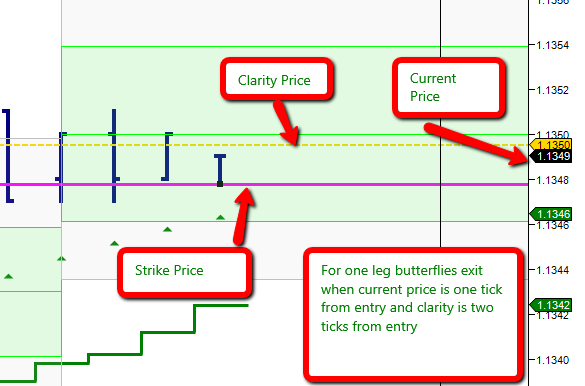

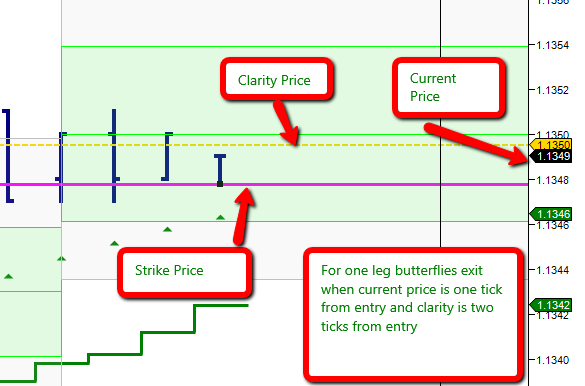

- For one leg entries, I exit when the current price is one tick away and clarity price is two ticks away

I set my entries for $85/$15 and take it to expiry unless my strike is hit. I keep my loss to around $20-$25 most of the time unless I get distracted by my kids, wife, dogs, cat, chickens, neighbors, cool breeze…you get the idea.

7 Likes

great post Gregorious! How long have you been doing this? I like how you have clear rules for entry and exit. Very clear descriptions. Thank you!

Thanks for the post ronin50. I have been taking these trades every day for about two weeks. I only concentrate one one currency pair at a time. My accuracy is about 92%-95%. I try to post all trades in the Nadex chat room. Will try to post some here too.

1 Like

Looks good! What time of day are you trading? I have been having relative success with hourly butterflies, but never considered 5 minute binaries. I will definitely give this a try.

Ironman10 thanks for the post. I trade throughout the day. Just try to avoid news and big movements in the market. My favorite time to trade the eur/usd butterflies is in the evening when both markets are closed.

1 Like

Very interesting and thanks for sharing! I’m assuming you have more success with this strategy during slowing time periods like around noon eastern or during the Asian session? I’m not able to get in the chat rooms very often do to work but if you could post some trades and their results here that would be great.

Thanks for your post binsking27. In the mornings most of the setups are single legs. There is definitely more butterfly opportunities at lunch and in the evening.

Gregorious and Grimnock are knocking these out in the Nadex Trading Pit helping others along the way make sure to hope in and join them. Thank you for everything y’all are doing to help. Traders helping traders!

Oh yes and all the below is just some of what has happened in just a few hours.

Single LapTop Setup

(the one loss was from breaking rules - self admitted and accepted - way to go man keep it up!)

New traders post getting the hang of it!

Some tips:

1 Like

Final score for the day not to shabby! Way to go guys!

1 Like

Very nice guys!!! I see a couple charts that are time based and some using diagnostic 3 tick for the forex trades. Do you guys find the 1 minute or 3 tick better for this strategy or is it just personnel preference?

hi binsking27! I use the one minute time based bar simply because for me it is easier to chart with. When I am looking back I can see exactly when a bar closed. I think it helps when posting charts.

Awesome! Keep up the good work! I’ll definitely be testing this strategy out in the Asian session later this evening. Thanks for sharing.

Brent

Many traders will have up both to see the expiration time. We are working on continuum bars that will have both price tick size built in as well as time sessions ie 5 minutes. to help even more on this. Adding more and more each month.

What indicators are you guys using specifically for this strategy? I see a couple different layouts here. How is the chop filter working with such short time frames and tick sizes? I use TC and the chop filter for futures and it’s been awesome! I haven’t found much success using the chop filter with forex, although I haven’t had much time to test it out, and I mainly trade NADEX binaries for forex not spot.

Binsking27, I use a one minute chart, expected range for hi/low and close to close set to 5 minutes, and default trend catcher

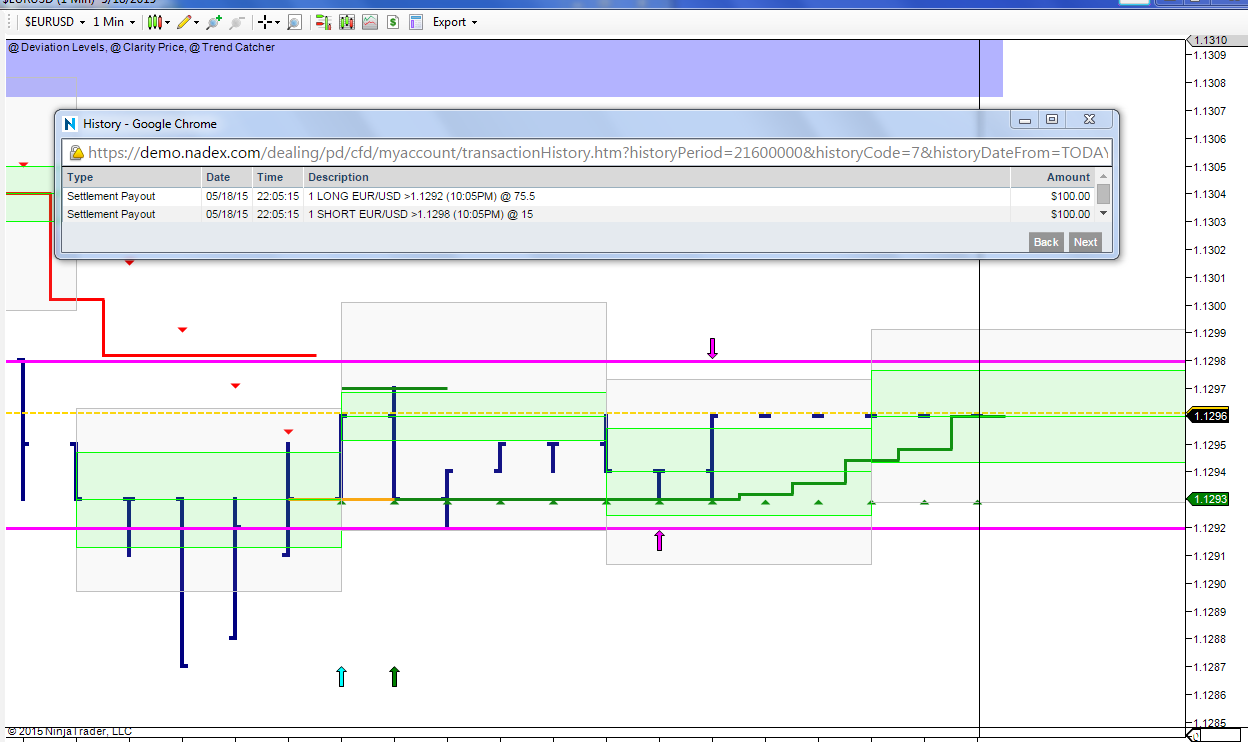

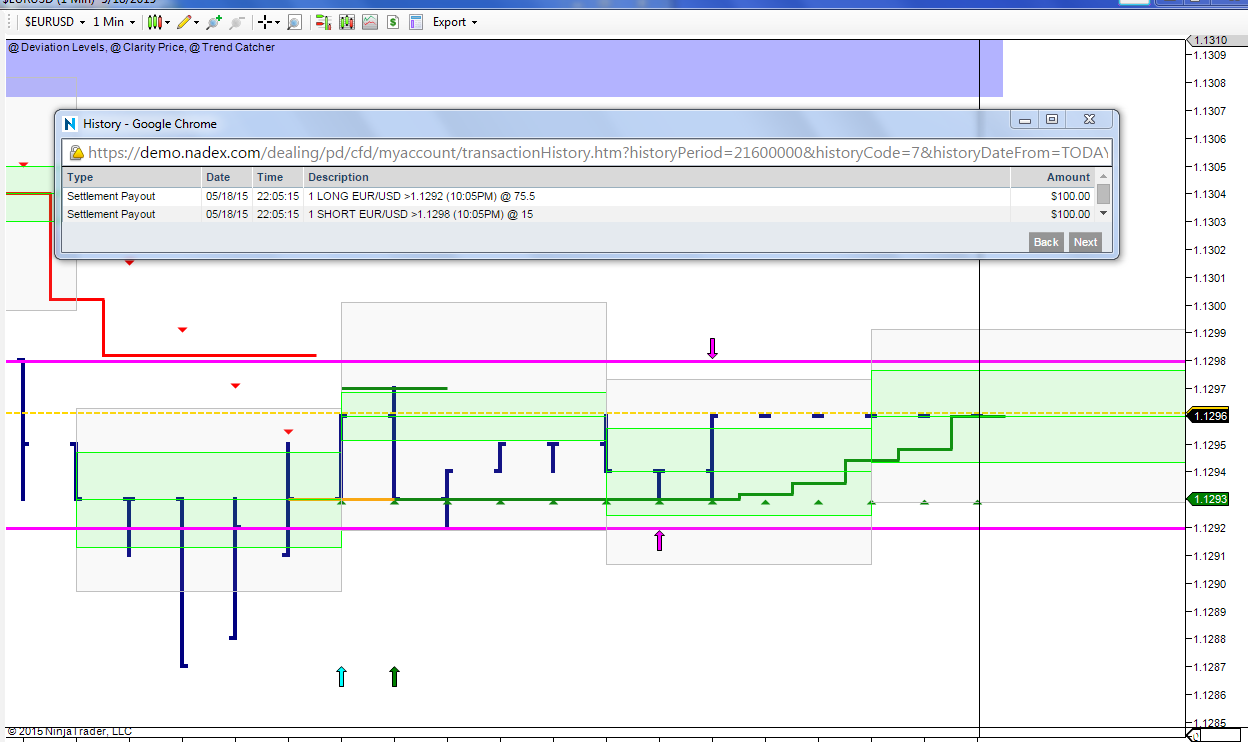

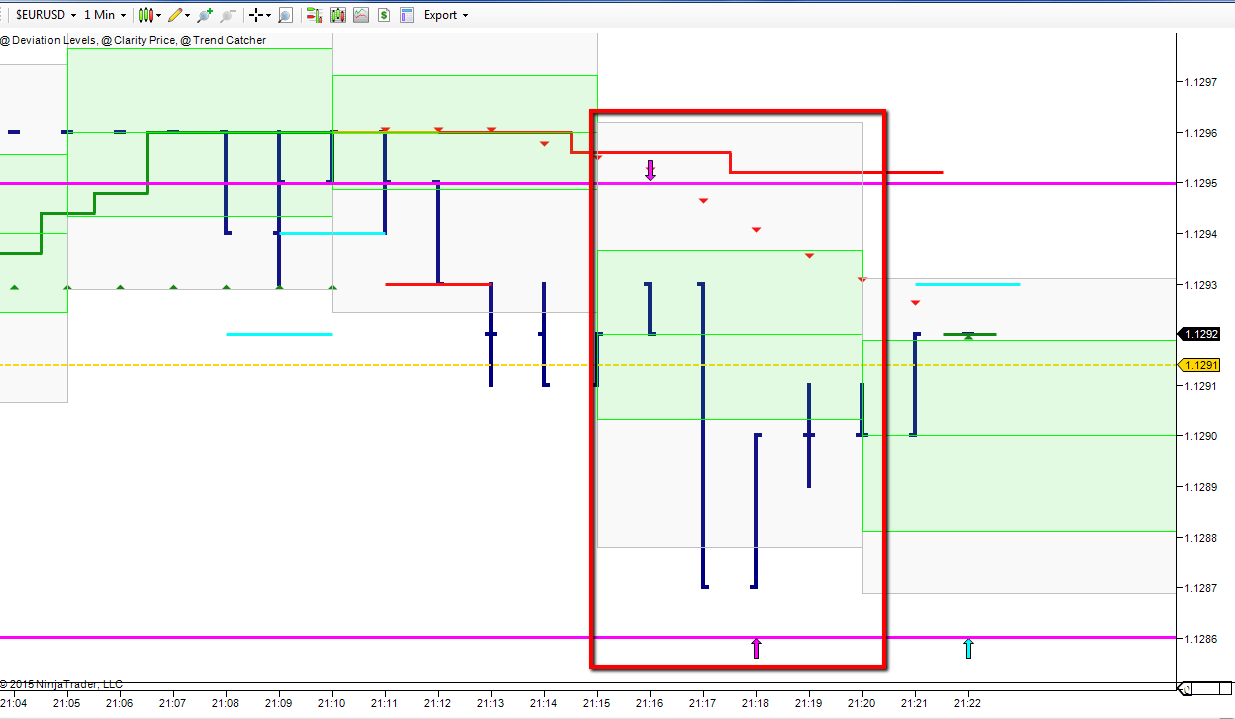

Here are two butterflies I took this evening.

Trade 1

First, I found a nice strike with the trend catcher three ticks below the market at 1.292. I always want to take my “against the trend” leg as far away as possible. In this case I was able to find a strike outside the hi/low range at 1.298. This gave me a butterfly of 6 ticks which is the minimum width.

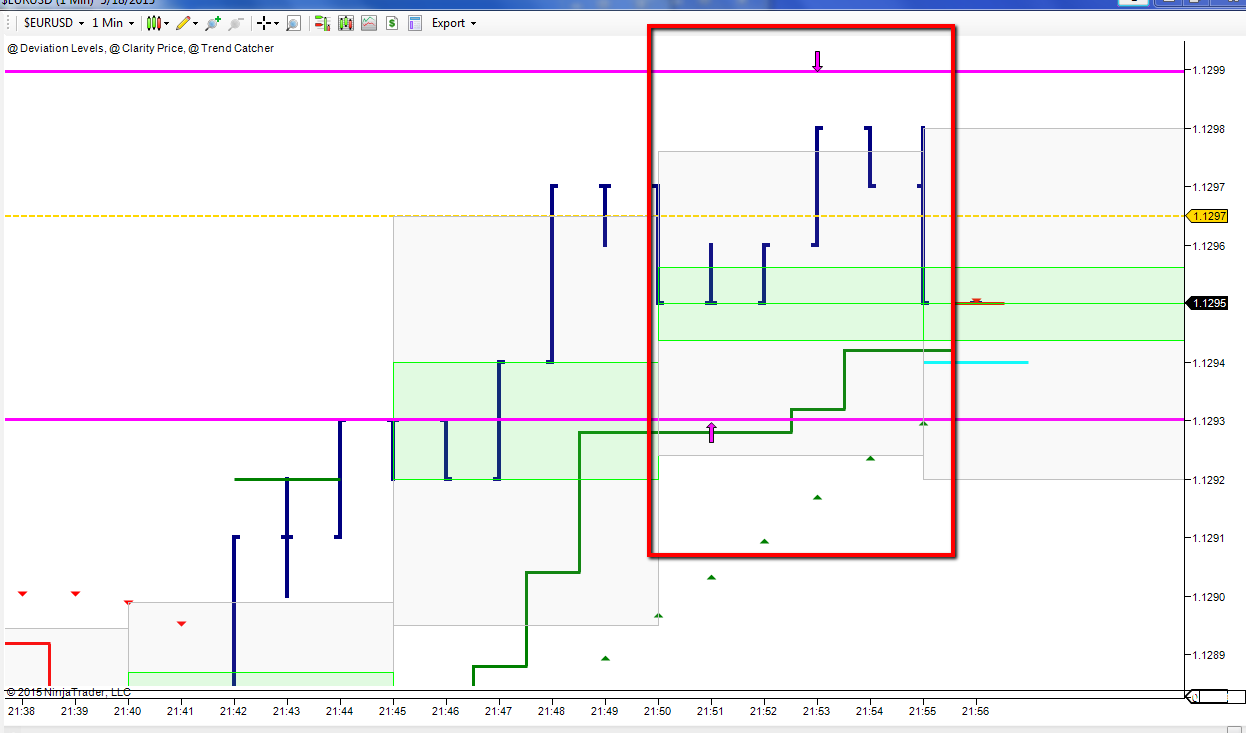

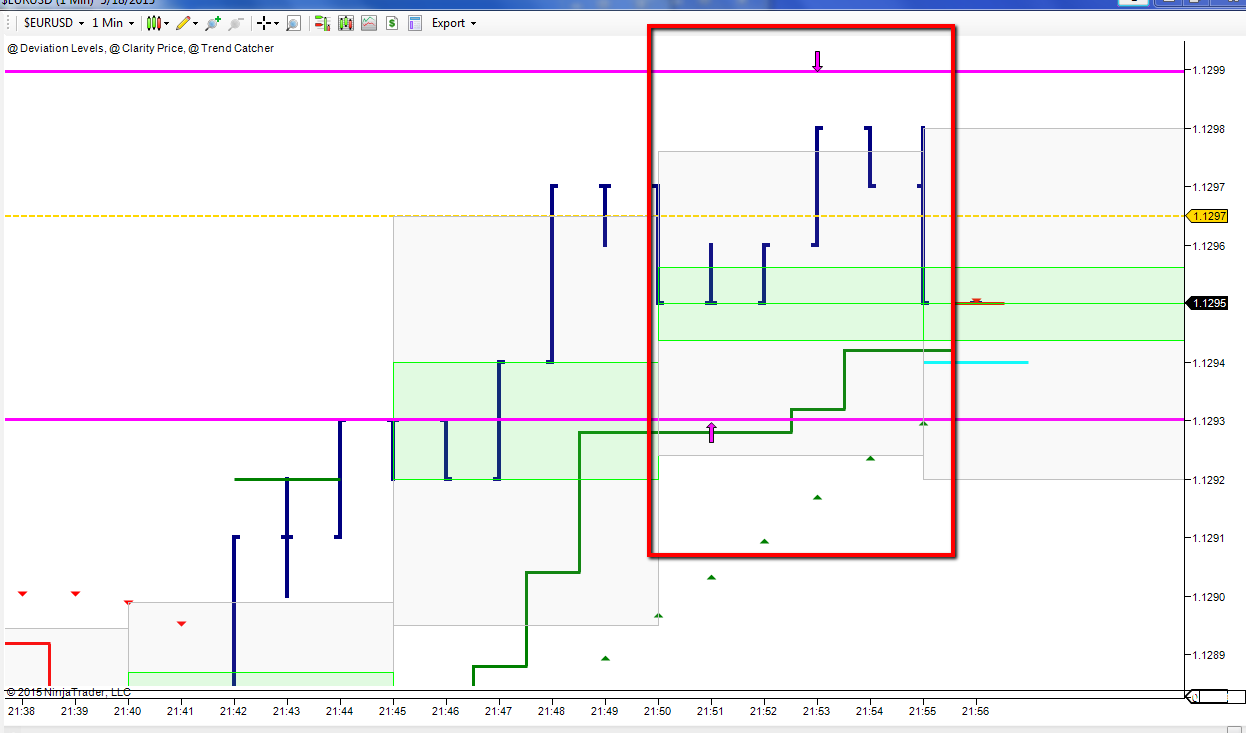

Trade 2

With this trade I was able to find a strike with the trend catcher three ticks away from the market within the first minute. The next bar had some movement to it so I wanted to see what this bar would do before I selected a strike. The bar started losing steam towards the end so I felt it was safe to select a strike. I took the strike as far away as I could. This butterfly was nine ticks wide.

2 easy wins!!!

One more trade for the night…another winner!

Took a strike with trend catcher pretty close to the hi/low edge. The market had no momentum. About 1 1/2 minute later I was able to get into the upper leg way outside the hi/low box.

1 Like

To all there was some confusion in the charts that Darrell posted. He was grabbing charts that Greg and I had been posting all day. Unfortunately some of those charts were some of my spread trades as well. So that is why you see some TC with Chop filter. And if you look at the instrument there those were for Gold. So ignore those as they really aren’t relevant to this thread. (Sorry I didn’t post those so I can’t remove those) Anyways, I was doing some playing with a 3 tick chart with different indicators to see if maybe I could find an easier way to see these setups. What I found is that Greg’s setup with 1 minute bars, Close to Close and High to Low expected ranges really is the easiest. So that is why you will see some of my charts change as the day went on. I was making adjustments to the chart on the fly… (Mine are the all gray with Black OHLC bars).

As Greg has already said, you want to find the first strike that is going with the trend somewhere around 3 ticks away. After that you then start looking for the other side, but you have to watch price and see where it is going or what it is doing. There really isn’t an indicator for this, yes the expected ranges gives you an idea, but it may well blow right through the expected range. Also pay close attention to news, as that will ruin your day.

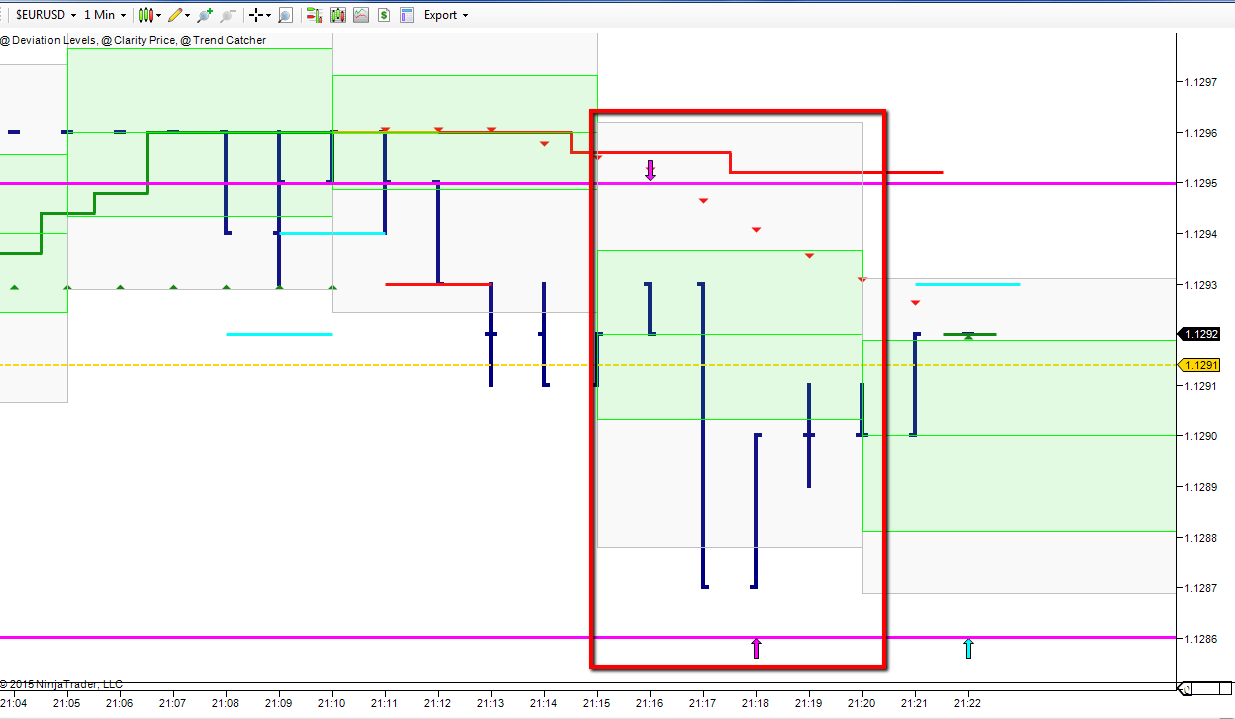

Here is a trade I did last night.

With this trade, I first selected my upper strike as that was with the trend. The start of the blue line is where I entered the trade. As you can see this was in the first minute. After that I continued to watch the price action for the period. I was looking for 1.288 as that was the only strike that was outside the close to close expected range. As you can see in minute 2 the price blew well down past it. However in minute 3 it shot back up and started loosing volume. So I took the long entry for this in minute 3. From there on out it was smooth sailing as price continued upward and expired with in both strikes.

Hope this helps …

Grimnokk

1 Like

Are you guys using the stop plugin for these trades?

I try and use it as much as I can

1 Like

I find it hard to get filled with first strike going with the trend about 3 ticks away.

I’m getting working orders and not fills.