By Darrell Martin

In the first article in this series, Premium was defined basically as time value and the expected movement in a specific option. It can also be referred to as extrinsic value, as it is the value outside of the option. To review the first article, read What Is Premium?

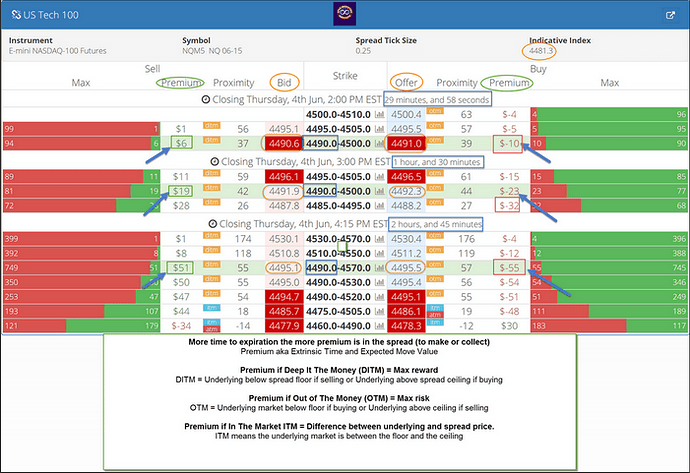

Calculating Premium Remember that premium is decaying over time. It is probably easiest to understand calculating premium by looking at an image.

First, let’s look at two different spreads both 4490-4500. The first number is the floor and the second number is the ceiling. In this example, 4490 is the floor and 4500 is the ceiling in these Nadex spreads. Look at the premium for the one that expires at 2:00 PM EST, (30 minutes.) You will see that it has $10 of premium shown. (Top right arrow.) Compare the next arrow down that expires in one hour and 30 minutes, at 3:00 PM EST. It has more than double the premium of the first one with $23. The premium goes up the further away you get from expiration. The more time you have until expiration, the more the premium costs. It is like car insurance. It would cost you more to pay for six months of car insurance than it would cost for three months. You would pay more premium because there is more time that you are covered by insurance.

Out Of The Money/Market (OTM) The little boxes between Premium and Proximity tell where the strike is in relation to the underlying market. The explanation given in the image above also helps to clarify how this relates to your risk and your reward.

If the spread is OTM, the max risk is the premium. What does OTM mean? It means that the market is lower than the floor on a buy and higher than the ceiling on a sell. There is no intrinsic value in an OTM spread it is all extrinsic or time value.

In the image, there were two spreads that were being compared that had the same floors, like a call strike, but with different expiration times. The top and middle arrow spreads are OTM having $10 and $23 in premium. The premium is the max risk. Looking at the bottom arrows, you will see a third strike with the same floor, but a higher ceiling: 4490-4570. It has an extra hour and fifteen minutes which gives it more time value, thus more premium.

Deep In The Money/Market (DITM)

If the spread is DITM, it might be helpful to think about it as being flipped upside-down and the premium is all max REWARD. If the spread is DITM, the premium is the max reward. Deep in the money/market means that the underlying market is below the floor if selling or the underlying market is above the ceiling if buying.

Talking About Profit

If you enter a spread trade and you sell, the most you can make is the difference between the price you sold at and the floor. For example, if you sold at 4495 and the floor is 4490, the most you can make is five points because it doesn’t get any bigger than that. It caps out.

If you are an options trader, you can think of it like a vertical spread. There is a certain amount at risk and there is a certain amount that can be made. If you sell five points higher than where the market is currently trading and the market stays flat, you make five points. You collect the TIME VALUE which equals the PREMIUM and on five points, that equals $50.

Other articles in this series explain:

-

What Is Premium?

-

Making versus Paying Premium

-

Which Contract to Choose

-

How Being Near A Strike Impacts The Premium in a Nadex Spread Option

Premium is an important part of your trading plan and so is your education. To learn more, visit www.apexinvesting.com, a service of Darrell Martin.