By Darrell Martin

In previous articles in this series, (see What Is Premium?, Premium: How To Calculate And Understand It and Premium: Make It Or Pay It), premium has been defined as time value. Implied Volatility and expected movement have been explained in relation to premium. Examples have been given to show you how to have premium work in your favor. This article will help you know which contract you should choose for your trades and how the market being near a strike price can impact the premium in a Nadex spread option.

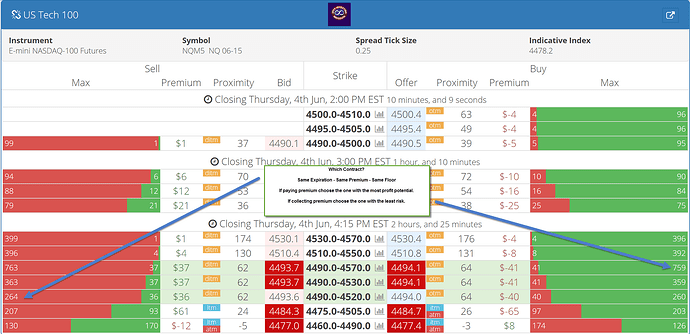

As shown in the other examples in this series, US Tech 100 will again be used as a reference. For the example in this article, let’s focus on the spreads with 4:15 PM expirations. When you look at the image shown below, you can see that there are three possible contracts highlighted in green. All three have the same expiration time, the same premium and the same floor. The premium on each spread is within a dollar or two of the other contracts. All things being equal, suppose each contract has $35 in premium coming in that you are collecting, which one would you choose?

This may seem like a daunting task to try to figure out which contract to choose. If you’re collecting premium, you want the one with the least risk. The blue arrow on the left points that out as 264. If you’re paying premium, you want the one with the most reward shown on the right at 759.

Apples To Apples

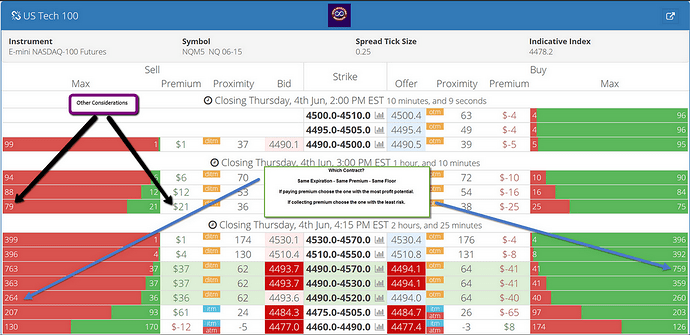

Something else to consider when determining which contract to choose is to compare your other options. The arrow on the left, the collecting premium contract risks $264 to get $36. You could look at other contracts that have less risk and do multiple contracts in order to have a similar profit potential.

Sometimes you can have less time to expiration and less risk, so that may be the contract you choose. You may think you have made the perfect choice only to realize that it has a lower floor or higher ceiling than the contract(s) you were comparing it to. Make sure you are comparing apples to apples by checking what your risk would be and the strikes as well. Do you want to go in and do several contracts with a little over an hour until expiration? Do you want to do one contract with a little more time until expiration? Answering these questions can make things a little trickier.

Generally, you want to choose the one with the least amount of risk with expiration time as far away as possible. However, if you look closely at the chart above, you may have noticed that directly below the three contracts we were comparing is another contract with a much higher premium.

A Strike With Higher Premium

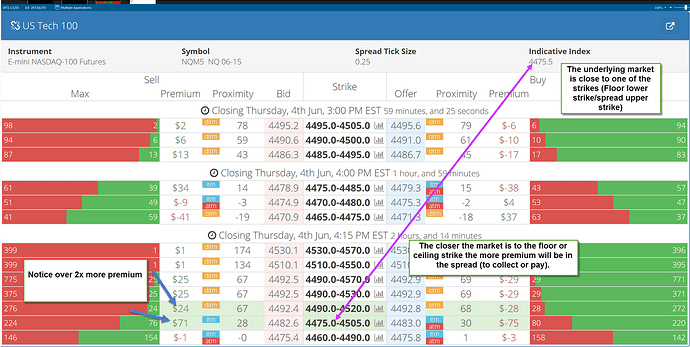

Look at the premium of $61 on the spread 4475-4505. Why does it have that much more premium? Remember that premium is impacted by time, implied volatility and news. How close the price is to the floor or the ceiling of a contract, or in a normal “vanilla” world, how close the market is to the strike, can also affect the premium. In the image above, the indicative is at 4478.2 and the floor of the spread is 4475. When the market is that close to the floor, it causes the premium to rise. In this case, the premium is at $61.

In this image, the market or the Indicative Index is at 4475.5 which is very close to the floor of this contract 4475.0-4505.0, as shown by looking at both ends of the purple arrow. The market is not even a point away. This is not the price of the spread. This refers to the floor of the spread. The NASDAQ is literally just a couple of points away from the floor of the spread so that is like an At The Market/Money (ATM) strike. If the market is closer to either the floor or the ceiling of the spread, depending on the direction you are trading, the premium will be higher because you get more money for less risk; that might be your chosen trade because you could choose to sell it and collect more premium.

The image above points out that the closer the market is to the floor or the ceiling strike, the more premium will be in the spread (to collect or pay).

You can see the valuable aspects of choosing your contracts wisely and the implications that choice can have on your trade. This should give you information that will help you make the choice that is right for your trading plan.

To further your trading education, go to www.apexinvesting.com, a service of Darrell Martin.