Here is the latest webinar covering the 3 entries, stops, targets and how to take profits:

5-19-2015

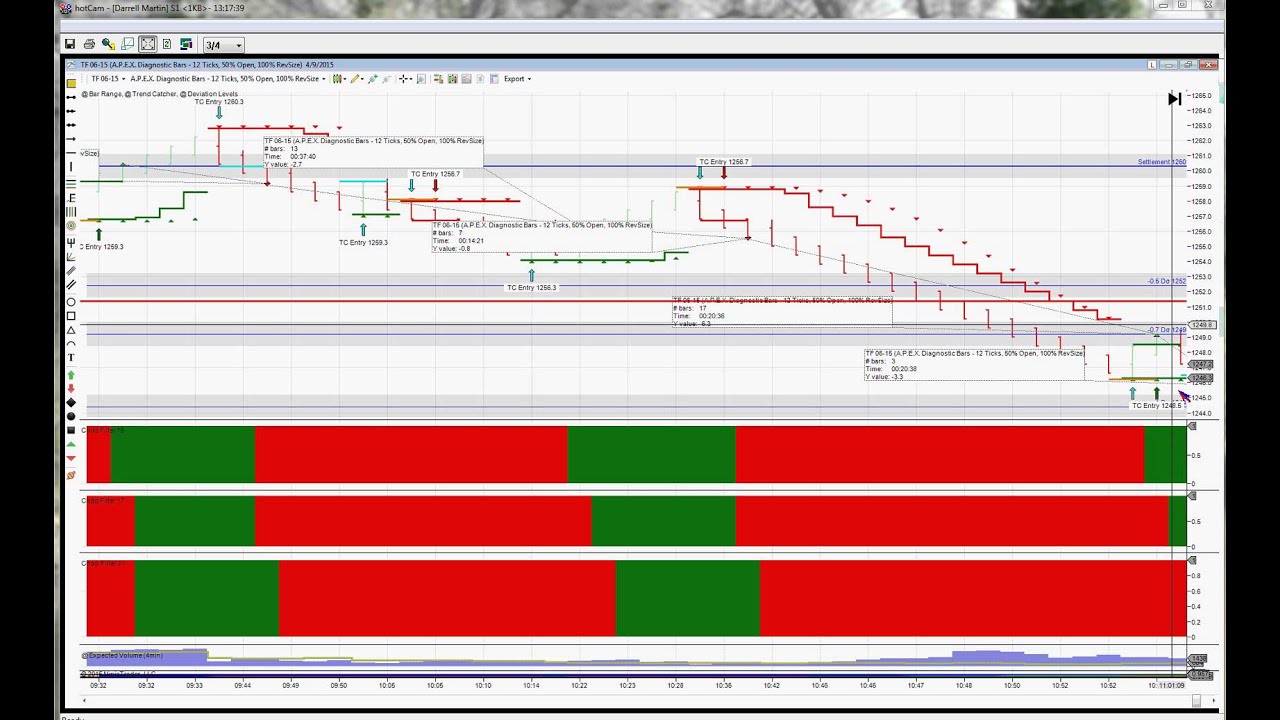

CONSERVATIVE ENTRY & EXIT RULES

- Cyan alert - heads up

- Solid arrow - get ready for possible entry

- Chop Filter confirms direction of trade (red = sell, green = buy)

- Enter 2 or 3 ticks below the low or above the high of the bar that the chop filter changes on.

- Set stops - bar size plus 2 ticks for a scalp or the MVP line for a trend

- Exit a trend when the MVP line hits the price action.

Explained: When you get a cyan arrow, look below at the chop filter.

A. If the chop filter color is the same color as our trend catcher line (red trend catcher line and red chop filter or green trend catcher line and green chop filter), then you can enter the trade 2 or 3 ticks above the high of that bar on a long or 2 or 3 ticks below the low of the bar on a short…

B. The conservative rules that everyone should start with on stops for scalp stops should be your bar size plus 2. If you are trending, trail your stop with the MVP predictor triangles. When they run into a bar, exit the trade.

C. NOTES: After you are profitable and have the rules down, then you can move on to more sophisticated methods of setting profit targets as you learn to read the market and watching magnet levels. Darrell explains how to find them in the following webinar:

Volume Webinar Lesson for Magnets

For more ideas and to add onto the basics, see this video:

Magnet Levels and Expected Time Indicator from Thursday 5/20 Webinar

Quick Review:

Long trend catcher, short chop filter: No entry.

Short trend catcher, long chop filter: No entry.

Long trend catcher, long arrow, short chop filter: No entry. The arrows mean nothing for entries in this method.

Long trend catcher, short arrow, short chop filter: No entry.

Long trend catcher, long chop filter: Enter a tick above the high of the bar where everything lined up.

Short trend catcher, short chop filter: Enter a tick below the low of the bar where everything lined up.

IS IT A SCALP (Profit Target trade) OR TREND TRADE

- Use the MVP arrow to determine if it will be a trend trade or just a scalp. If the MVP arrow appears on bar 3 or 4, that indicates a trend trade. The bar with the cyan arrow is bar counted as bar 1. IF the MVP arrow appears on bar 1, 2, 5 , 6, etc., then it is a scalp trade. IF the MVP arrow appears on bar 3 or bar 4, then it is a trend trade.

- What should my profit target be for a scalp? A good rule of thumb is the bar size minus 2 ticks. A more advanced way to determine a profit target is to use magnet levels. The link for a recent webinar about using magnets will be listed here as soon as it is available.

- How many scalps can I take within a single trend? The scalps that are consistently profitable are the first in any trend. If you have a slingshot setup and then an elevator (In that order), they often will both be winners. If you have an elevator first, then a slingshot, taking the second in that series, i.e.,the slingshot, the instance of profitability is less. If you take a scalp before the MVP arrow appears, you can take an additional scalp after the MVP flips within the same trend.

ADD-ON ENTRIES INTO THE TREND Potentially the scalp entries below could be considered add-on entries.

ADDITIONAL SCALP ENTRIES

The “SlingShot” Setup A bar that has a cyan arrow against the current Trend Catcher direction but closes in the same direction as the current trend is a slingshot setup. You must wait for this bar to close before entering. The entry would be a tick above or below the high or low of the slingshot bar. See screenshot below:

The “Elevator” Setup Conservative Elevator setup is if you see a trend and there is a bar that signals a direction reversal with TC, i.e., it’s signal is against the current trend, but in the next bar it returns back to the original direction, this is an ELEVATOR setup. To be a valid elevator entry, there must be at least 2 bars in the “trend” direction prior to the elevator bar. Example: If you have a short trend, there must be 2 red or down close bars before the elevator in order to make it a valid elevator setup. If not, it may be just chop. An advanced Elevator entry would be to exceed the high or low of the first bar that closes in the opposite direction of the MVP (there can be more than one bar in this instance).

Where do you enter the “elevator” trades? You enter when the high or low of the elevator has been broken or the high or low of the next bar, whichever is a higher high or lower low. If the elevator bar had a long wick, this may take a few bars, but that is acceptable. NEVER enter an elevator trade until at least the next bar has closed. You have to make sure this is not a reversal and actually is an elevator entry. If there are 2 or more bars that change color, it is NOT a valid Elevator.

You may notice the elevator in this screenshot is not the first in the trend. The market is ZB which is a market that allows for more scalp setups than any other market.

How many scalps can be taken in any given trend? The best setup is always the first one in a trend. However, you can take 1 before the MVP flips (or more but there will not normally be more) and then you can take another after the MVP flips. If, within a single trend, there is a slingshot followed by an elevator, the elevator usually stil has a high rate of success; however, if the elevator comes first followed by a slingshot, the slingshot is usually not as powerful to make it to your intended goal. The bonds market is an exception as it trends so well, as long as you are following the major trend, any number of scalps can be taken.

Here is an image that illustrates an important rule to keep you out of potential chop. This rule ONLY applies to trend setups (when the MVP arrow appeared on bar 3 or 4) It is called the Predictor Close Rule:

MISCELLANEOUS SETUP EXAMPLES:

This is a screenshot submitted by a trader with lots of examples of different trades from ZB. I marked up what setups were what. It might help you to see entries more clearly .

TEMPLATES AND SETTINGS

The template in the toolkit used in this video is called _TrendCatcherChopFilter as illustrated in the image below.

Here are screenshots of the settings you should use for the Trend Catcher with this method. Be sure to note that it is VERY important to use a trend measurement period of 7 in the trend section and to set stats and sim trades to false. Stats and sim are not yet linked to the Chop Filter Indicator, so the positive effects of this filter will have NO effect on them whatsoever. They will be linked at a later date which is not yet determined. We will announce it when it has been linked.

Trend Catcher settings

/media/6d090df6-d894-47df-9a32-31a65455a0e2/04.10.2015-14.11.png) Chop Filter settings

Chop Filter settings /media/92e84c67-5637-45f1-90fb-76ea00031b63/04.10.2015-14.11.png)

It is also recommended that inside the trend catcher you set the predictor line inside the trend catcher to transparent so that you do not confuse the MVP predictor line with the Trend Catcher predictor line since we are now using the MVP predictor to trail the stop.

You can adjust the chop filter settings somewhat. Below is the video Darrell did on Friday as well with some tips and tricks on optimizing and making adjustments to the chop filter indicator.

It is recommended that you include the measurement period in the label of your filters you have added for testing. This can be added under the Visual panel in the Chop Filter as shown in the image below. This will allow you to know at a glance what size filter is which.

To learn how to apply this to spreads click this link:

it can be used on Spot Forex!

it can be used on Spot Forex!